Pork Commentary

Jim Long President – CEO Genesus Inc.

September 9, 2013

US Hog Market Stays Strong

Last week US 53-54% lean hogs were just over 90¢/lb., a year ago they were about 72¢/lb. That is 18¢/lb. difference is pushing hogs to the better almost $40 year over year. Huge difference. Almost $100 million a week more for the North American Industry. A year ago we were losing gobs of money. Now making some. US Feeder pigs year over year are also a big difference, a year ago US 40 lb. feeder pigs were about $16, now $56. The same $40 per pig change year over year. The reason – supply and demand. We believe the supply of pigs year over year is not much different while domestic and global demand is better. July US pork exports were 7.5% higher year over year. The increase in Pork Exports is enhancing US hog prices and a part of the $40 per head increase. Mexico Pork exports were strong in July and now we understand Mexico is encountering PED. Like USA we expect their domestic production will decrease due to this scourge. Less Pork available always increases prices.Smithfield

On Friday Smithfield Foods received approval for its sale to Shuanghui International from the US Government’s Committee on Foreign Investment. Now the only hurdle is the Smithfield Shareholder vote on September 24. Minority shareholder (5.7%) Starboard is arguing the purchase price is undervaluing Smithfield. We expect the deal will proceed. The purchase will in our opinion increase pork exports to China. We do business in China and we believe that long term 10-20% of China’s pork needs could be imported. That would be equivalent of 60-120 million hogs per year. We believe Shuanghui sees the same scenarios. They are quite wise in such a situation, knowing there’s a long term market – purchase the world’s largest production base, packing plants and know how at a cost probably at half of what it would take to build new. Of note, Chinese hog producers don’t like Smithfield purchase as they see it also as competition from pork imports long term. China’s hog price is currently $1.20 USD/lb.Corn

US December Corn closed at $4.68 a bushel Friday. $1.00 a bushel less than it was mid-June. Of note in Rondonopolis, Brazil last week corn was $2.73 USD/bushel. Lower feed costs for our industry are definitely here and will continue.USA-Canada Inventory

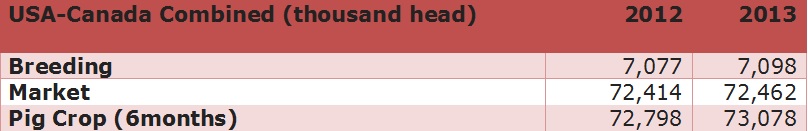

We believe when we look at Hog Price Scenarios for USA-Canada you have to look at combined inventory. We are all selling hogs off the below numbers. Not much change year over year. In the meantime, Beef supply has dropped, the US economy is somewhat better, more people in USA and the world, the world economy better, the high hog prices other countries have Russia over $1.00 US Liveweight a lb., China $1.20 USD/lb. liveweight, Spain 91¢ USD Liveweight a lb. etc. The talk of sow herd expansion has not happened. The sow herd at early summer 2013 will be the production machine for next summer’s hogs. When we look at domestic and global pork demand, the prices in those import countries, the continued decrease of beef production and those subsequent higher prices. Consequently we see no significant increase of hog numbers by next summer. We have no reason to believe 2014’s hog prices will be not be as good as 2013’s with upside potential. $1.00 lean hogs with definitely cheaper feed. Next 12 months will be good. After that – Who knows?Categorised in: Pork Commentary

This post was written by Genesus