Bob Fraser – Sales & Service Ontario, Genesus Inc.

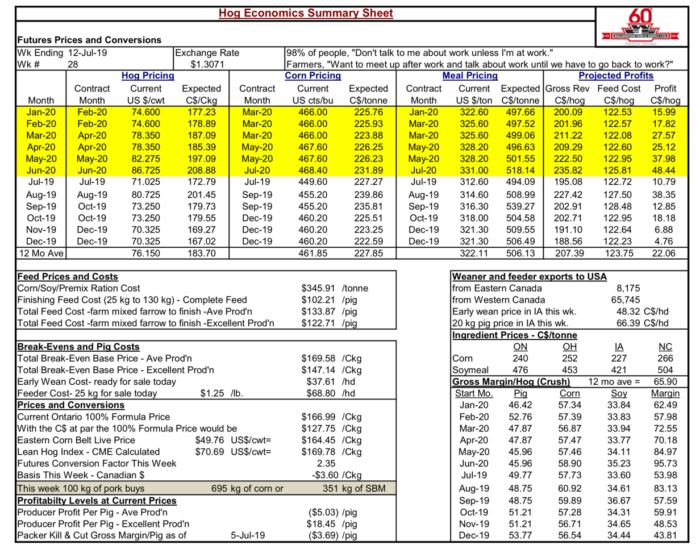

In my last commentary Bob Hunsberger, Wallenstein Feeds, Hog Economics Summary Sheet showed from the previous eight weeks, a tremendous and unprecedented reversal of fortunes with profitability going from per pig with average production loss of (-$34.07) to profit of $55.39 per pig with average production. An unbelievable $89.46 per pig increase in record time! Then with the next twelve-month projection moving from $20.98 to $70.10.

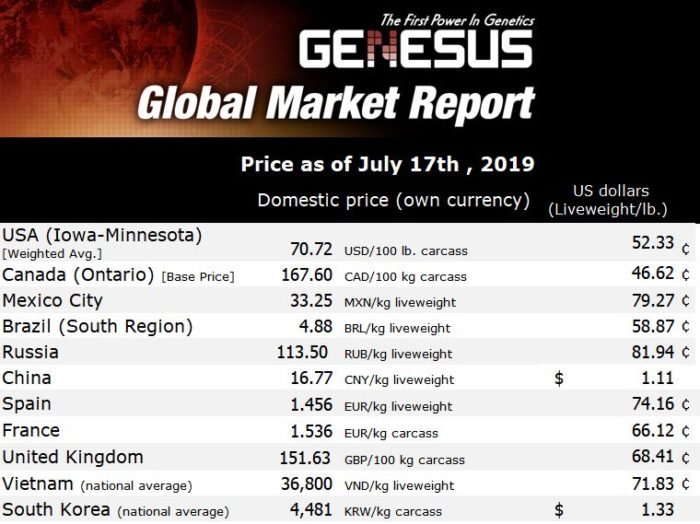

Now a further eight weeks on we have profitability going from per pig with average production profit of $55.39 to a loss of (-$5.03). A reversal of $60.42 per pig. That is a two thirds erosion of the previous eight weeks gain. Then with the next twelve-month projection moving from $70.10 to $22.06. to say “the bloom has come of the rose” would be a vast understatement. So, what’s going on?

Well, a one two punch.

Total feed cost – farm mixed farrow to finish – average production has moved from $112.51 per pig to $133.87 per pig, driven primarily by the big run up in corn price. If you dirt farm here or in the Midwest as most Ontario pork producers do, you know all about that and the challenges of getting a crop in this spring. The squeeze on margins from the other side comes from the Ontario 100% formula price eroding from $201.79/ckg to $166.99/ckg. This is not how things were supposed to work particularly in July and especially with the promise of China.

What of China?

While the whole situation very much borders on incomprehensible some clarity is beginning to emerge.

- First, a lot of the pigs thought to have died or been destroyed have in fact moved into the food stream. Along with that many Chinese producers faced with the likelihood of contacting ASF have opted to liquidate placing even more pork into the system.

- Second, the world has become aware that China has massive reserves in cold storage. Suggestions from talks at last week’s National Pork Industry Conference (NPIC) in Wisconsin Dells, place it as large as the annual pork production of the US. Apparently beginning July 1st China was to begin testing meat at slaughterhouses and out of cold storage for ASF. The consensus, again at NPIC, is they aren’t going to find any. They need the pork!

North America has record pork production and as Canadian producers with 75% of production exported have long known what our American friends with 25% of production now exported are learning. That any disruption to exports can lead to a world of hurt. Canada is experiencing that presently in spades

Canadian Pork Exports to China Temporarily Suspended by CFIA as a Precaution

“Canadian pork producers were informed today that China will no longer be accepting Canadian pork products due to concerns regarding the validity of an export certificate. As a result, the Canadian Food Inspection Agency has stopped issuing export certificates for China for all pork and beef products as of June 25, 2019. ”

source: CPC Press Release

The above is just one more irritant between Canada and China since RCMP arrested Meng Wanzhou, a top executive of Chinese telecommunications giant Huawei, Dec. 1 on fraud charges at the request of U.S. authorities.

As a pork producer forty years ago, one would have thought a Chinese woman being arrested in Vancouver has nothing to do with you. If Canada was a pork import nation that might remain true however as we are a major world pork exporter we are finding it has everything to do with us.

Conestoga Meats celebrates 25 years

Conestoga Meats welcomed hundreds of employees, producers, family members and supporters to their main facility on Saturday, June 22. The event was held to celebrate the opening of the company’s new expansion, and the 25th anniversary of the organization.

Conestoga now provides approximately 36 to 38,000 head per week of much needed processing capacity to Ontario. A testament to the foresight and tenacity of its producer shareholders. Well done!

Categorised in: Featured News, Global Markets

This post was written by Genesus