Canada – Ontario Pork Industry Profile

Bob Fraser – Sales & Service, Genesus Ontario

bfraser@genesus.com

Ontario Pork Industry Stats from Ontario Pork website:

- 1,284 pork producers marketing 5.39 million hogs – 4.3% more than 2015

- 8% of producers market more than 3,000 hogs – up 2.5% rom 2015

- 6% of producers market between 500 and 3,000 hogs per year – down 1.5% rom 2015

- 6% of producers market fewer than 500 hogs per year – down 1.0% rom 2015

- 45 million pigs in Canada – 3.2 million pigs in Ontario including 311,900 sows and bred gilts

- Ontario’s share of the North American hog market 4.1% in 2016

- Ontario exported 912,904 pigs weighing less than 50 kg to the US

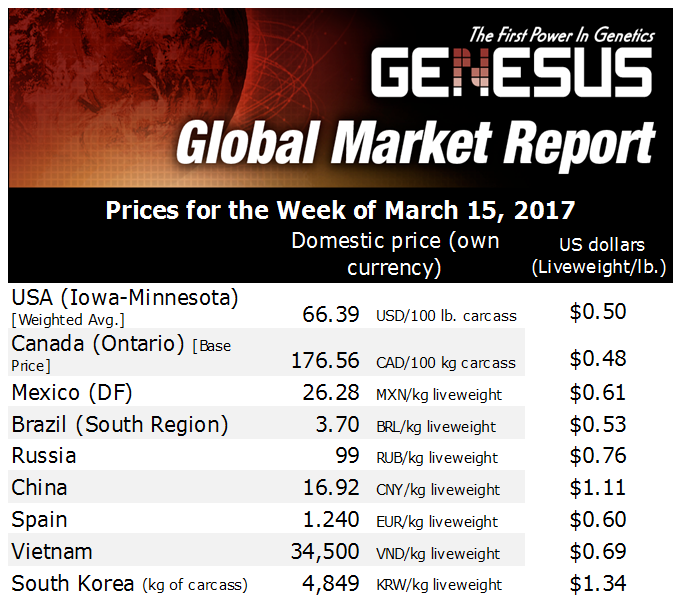

- Average 100% formula price $155/ckg – down 6.6% from 2015

- Average cost to produce a hog in Ontario $159/ckg – up 1.1% from 2015

- Top export markets for Canadian Pork – #1 U.S. (33% of exports), #2 Japan (25% of exports), #3 China, #4 Mexico, #5 South Korea

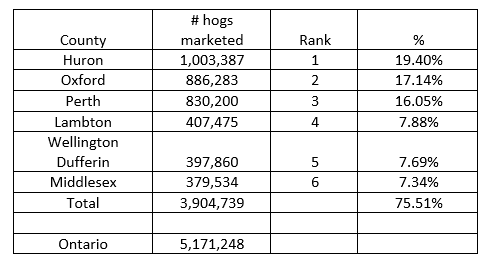

The following two tables put a finer point on the structure of the Ontario industry. Seven counties make up 75% of the hogs, with three counties contributing 50%+ of the marketing. All of this would be within an approximate 80 mile radius of Stratford Ontario. This table shows the same 50-year plus trend throughout North America (and probably the world) of further specialization leading to fewer producers, but the ones left producing more hogs per producer. Perhaps the slight variation in Ontario would be 90% plus of the producers are land based growing most if not all their feed requirements. The old 80/20 rule would very much apply with 20% of the producers producing 80% of the hogs. Actually, 90/10 may be closer to the reality.

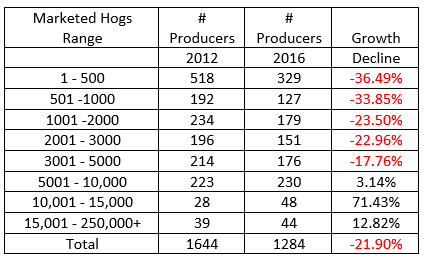

This table shows the same 50-year plus trend throughout North America (and probably the world) of further specialization leading to fewer producers, but the ones left producing more hogs per producer. Perhaps the slight variation in Ontario would be 90% plus of the producers are land based growing most if not all their feed requirements. The old 80/20 rule would very much apply with 20% of the producers producing 80% of the hogs. Actually, 90/10 may be closer to the reality. Below, compiled by the OMAFRA Swine Team OMAFRA.Livestock@ontario.ca, is how things have been running for the last five weeks. The traditional seasonal trend seems to be well in place with margins plumping up nicely and a welcome reprieve from the 4th quarter.

Below, compiled by the OMAFRA Swine Team OMAFRA.Livestock@ontario.ca, is how things have been running for the last five weeks. The traditional seasonal trend seems to be well in place with margins plumping up nicely and a welcome reprieve from the 4th quarter.

Categorised in: Featured News, Global Markets

This post was written by Genesus