Bob Fraser – Sales & Service, Genesus Ontario

Canada – Capital & Courage

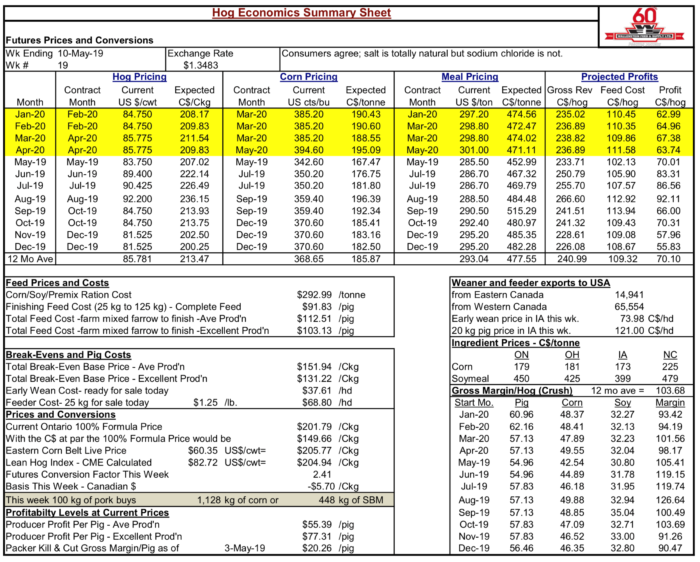

Bob Hunsberger, Wallenstein Feeds, Hog Economics Summary Sheet shows from eight weeks ago, a tremendous and unprecedented reversal of fortunes with profitability going from per pig with average production loss of (-$34.07) to profit of $55.39 per pig with average production. An unbelievable $89.46 per pig increase in record time! Then with the next twelve-month projection moving from $20.98 to $70.10.

In my last commentary I suggested “Perhaps the cavalry is showing up just in the nick of time!” That now appears to be the understatement of the year (decade). I also suggested that if there wasn’t significant capital flow into this industry its continual decline appeared all but inevitable. So now what? The capital is now flowing (gushing) in and although we’ve experienced some volatility in the futures market the cash has continued its steady march upward beyond, I expect every producers’ best dreams of little over two months ago. Therefore, the capital is going to be there. Certainly, for the next twelve months with reasonable expectations for a good period beyond that. In the past this would lead to expansion, even massive expansion. Is it different this time? Suggesting long established cycles and trends “are different this time” usually proves a fool’s errand. However, some things to consider.

Another very key component to this business along with capital is courage. As Jim Long has observed pork producers are fearless. “The platoon you want to be in to go to war.” Although fearless doesn’t equate to crazy. The list of things that might go wrong in the industry always seems to be longer than the things that may go right and getting longer.

Even laying aside the possibility of an ASF “black swan” landing on our shores this industry appears to have become considerably more volatile. Who in the past would have thought the arrest of some Chinese woman in Vancouver, some random tweet of a US President had anything to do with you and your pork business livelihood? As we’ve come to learn perhaps a considerable amount. This coupled with ever increasing regulation, red tape, labour challenges, mounting environmental and welfare pressures certainly makes entry or expansion into this industry not for the faint of heart.

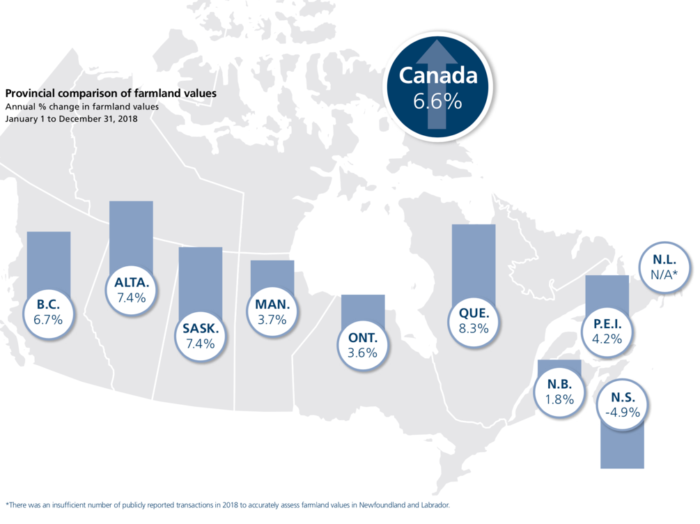

Here in Ontario at least one provider of ballast against all this has been land. The Ontario pork producer’s original integrated model of land to pigs to manure to corn and back around has proved a very stabilizing and sustainable one. The tremendous appreciation of this land as outlined in the tables below has proven to be considerable ballast against the storms of the last decade and beyond. Certainly, for those on the inside looking out. Those that have accumulated a land base over a reasonable period of time. However, for new entrants that ballast may look more like a boat anchor to entry. Twenty thousand dollar per acre plus land added to the cost of a new hog operation brings a whole new set of challenges. Likely to require some new and innovative models at least if we’re interested in seeing anyone new to the game. Already seeing some of this as some established producers are getting creative on how to bring new entrants into the industry and perhaps solve some of their management and labour challenges.

This industry always remains interesting but hopefully the recent turn of events is going to make it even more so in a positive way.

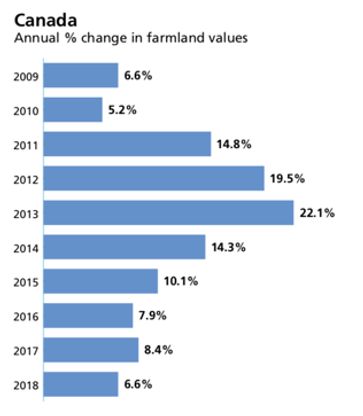

See below a summary of the FCC FARMLAND VALUES REPORT, published on April 29th 2019, that covers the period from January 1 to December 31, 2018

National trend

The average value of Canadian farmland increased 6.6 per cent in 2018, following gains of 8.4 per cent in 2017 and 7.9 per cent in 2016.

In all provinces except Nova Scotia, average farmland values increased. Quebec experienced the highest average increase at 8.3 per cent, followed by Saskatchewan and Alberta, both at 7.4 per cent, and British Columbia at 6.7 per cent. The rest of the provinces were below the national average with Prince Edward Island’s average increase at 4.2 per cent, Manitoba at 3.7 per cent, Ontario at 3.6 per cent and New Brunswick at 1.8 per cent. Nova Scotia recorded a decrease in average farmland values of 4.9 per cent.

Note that in Newfoundland and Labrador there were not enough publicly reported transactions to fully assess farmland values. When looking at the national results, it’s important to remember the reported number is an average. The differences between regions within each province vary widely.

Source: https://www.fcc-fac.ca/home.html

Categorised in: Featured News, Global Markets

This post was written by Genesus