Lyle L Jones, Director of Sales in China, Genesus Inc.

MARKET INFORMATION:

- China’s pig inventory numbers have declined by 32.2% in July compared to the same month one year ago according to the most recent MARA report.

- July sow numbers were down 31.9% since the first reported ASF outbreak in China one year ago.

- ASF is still active so it is anticipated that the decline in the pig and sow inventories will continue in the second half of 2019.

What effect is this reduction in inventories having on the markets?

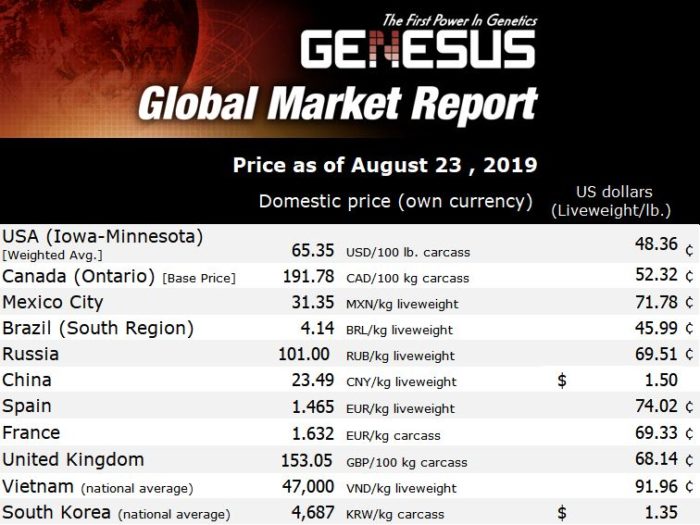

Let’s take a look at the following Graph of Slaughter hog prices from January 1 thru August 19, 2019.

Graph of Slaughter hog price from Jan to Aug 2019.

Orange is Year 2019, RMB/Kg

One can see a steep upward trend since May of this year in slaughter hog prices and has now surpassed the 2016 record. We believe this is result of heavy sow liquidation during the first quarter and purge of pigs going to the market to avoid loss to ASF.

The latest published national average price is 23.49 CNY/kg or $1.52 lb., U.S. However, we just received word that the price continues to climb and is now at 24.99 CNY /kg ($1.62 lb.) U.S. based upon 16 provinces monitored by MARA. Last week the highest price recorded in China was in Guangxi province at 29 CNY/kg or $1.86 U.S., live weight a lb.

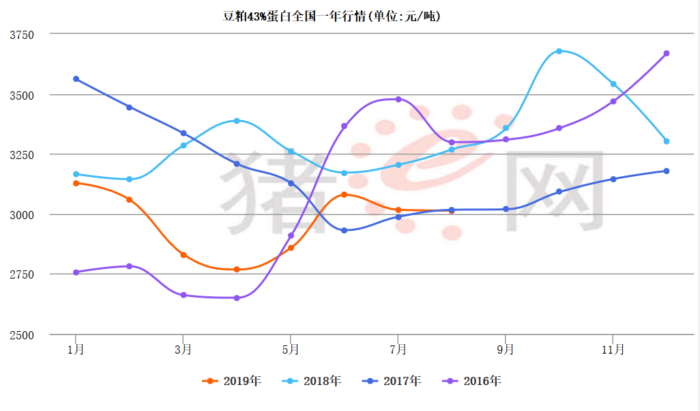

So what are Grain prices in China looking like during this time?

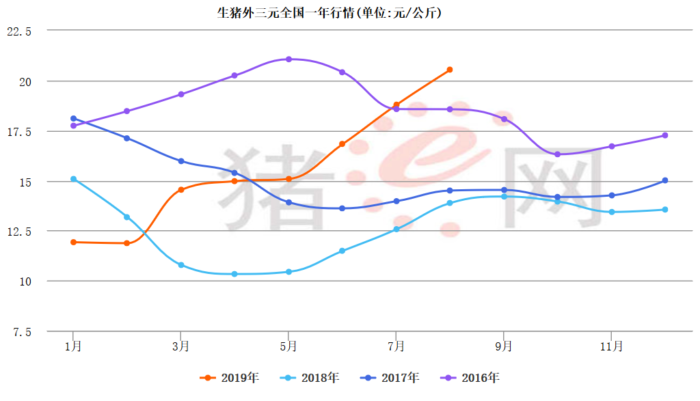

Graph of the Corn Price from January to August 2019 in China

The average price of corn is 2008 CNY per ton ($7.50/bu. U.S.) which is twice the price in the U.S., but still works within the market conditions in China. There hasn’t been much movement in Corn prices since June in China and the trend has been relatively flat since then.

There are no indication that Corn prices will change much with the abundant Supply Worldwide, harvest nearing and significant shortfall of pigs in China. Basic Ag Econ 101 principals of supply and demand rules apply.

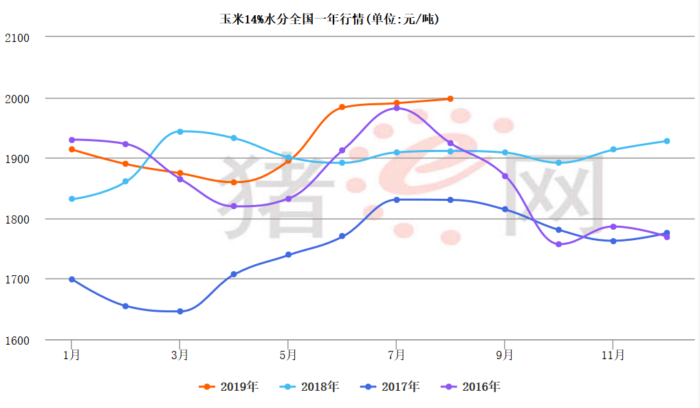

Now, let’s take a look at Soybean meal in China since the first of the year.

Graph of Soybean Meal Price from January to August, 2019 in China

The average price of soybean meal is 3000 CNY per ton ($400/ton), which is down from 3150 at the start of the year. This is a pretty ugly trend line if you are a soybean farmer in Illinois or Iowa. Again, basic supply and demand principals apply with these commodity prices. With 16-20% fewer pigs in all the world that won’t be eating pig feed- we don’t see not much upside movement in the price of Soybean meal for some time.

So what does all this mean for producers in China? It means that if you are a pork producer in China and you have pigs to sell you are likely making big profits on the pigs you are able to market.

Example: If your cost of production on a 115kg (253lb) slaughter pig is 1200 CNY ($171 U.S) and you are selling them at 23.49 CNY/kg ($1.52 lb.) or 2700 CNY- your profit would be 1500 CNY per head ($212 U.S.). That’s big money!

OBSERVATIONS:

With the price of corn hovering around 2000 CNY/ton and the national average hog price at 23.49 CNY/kg ($1.52 lb.) U.S., the pig to grain ration has surpassed 11.50:1.

According to the policy in China, when the pig to grain ratio is higher than 9.5:1, the National Development and Reform Commission takes the lead in consultation with other ministries to increase sales from the frozen pork reserve and other measures to prevent price fluctuations.

Also, we hear many reports of producers keeping back thousands, tens of

thousands and even in one case hundreds of thousands of commercial gilts off

their finishing floors to retain back into their breeding herds. While this may

be a short term step to address the vast shortage of breeding animals, it will

set production efficiencies back substantially and not a long term solution.

Furthermore, we are aware that recently there was a meeting with the Premier to address the continuing upward rise in pork price and restock production. Our understanding is that several measures were launched in an effort to stabilize pork prices. These measures include:

- accelerating the distribution of subsidies for compulsorily culling

- local governments should cancel any restrictions that may go beyond the currents laws.

- abolish the 15 mu maximum land restriction to encourage large scale production

- strengthen animal epidemic prevention systems and disease control

- increase local pork reserves ensuring affordable pork to the citizen an

- increase social security benefits so as to ensure the basic livelihood of the people in need.

Summary:

I don’t think anyone really knows how high pork prices will go in China nor how long they will remain at these record levels. The answer may depend upon how long it will take to rebuild the pork industry and domestic supply.

Cold storage reserves and increased pork meat imports will help in the short term, but importing high health Genetics from ASF Free Countries like Canada to restock one’s own breeding farms may be a more strategic long term solution.

Categorised in: Featured News, Global Markets

This post was written by Genesus