Lyle L. Jones, Director of Sales, China

What’s going on in the China Hog Market.

There is no more important holiday in China than Chinese New Year (February 10th) and Spring Festival. Normally, Chinese consumers stock up on pork for the holidays driving up pig prices and producers enjoy their highest margins. This year something abnormal is happening as Piglets prices have risen for 5 weeks, while live slaughter pigs have declined.

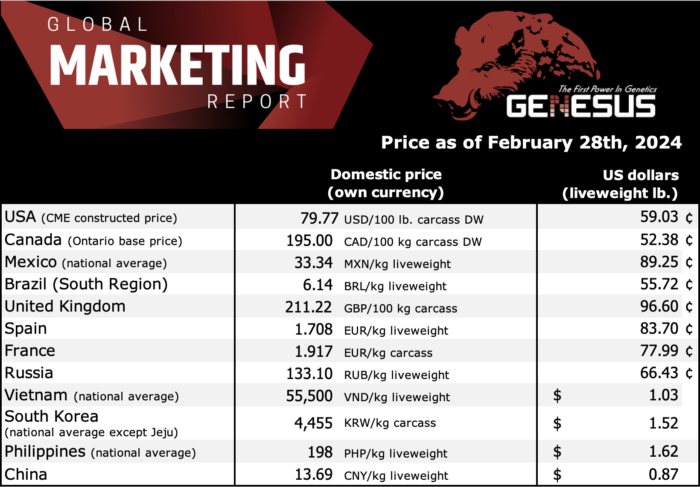

The hog market after Spring Festival can be described as “Hot” and “Cold”. Live slaughter pig prices have fallen after a brief rebound before the holiday. This week, domestic pig prices are declining. On February 23, the price of live pigs was 13.69 yuan/kg, ($0.87/lb.) down 15.2% from 16.15 yuan/kg ($1.03) only one week ago. The national average for the week was 14.4 yuan/kg ($0.91), down 7.7% compared with the average price of 15.6 yuan/kg ($0.99/lb.) before the holiday.

Unlike the live slaughter pigs, weaned pig prices have taken off. During Spring Festival, 15 kg feeder pig prices continued to rise topping 500 yuan/head ($69.45) in regions. Since, Spring Festival the national average price of 7kg weaned pigs rose to 478 yuan/head ($66.39) compared to about 332 yuan/head ($46.11) before the Spring Festival.

Weaned pig and feeder pig prices are a barometer for future slaughter pig prices. The recent rise in piglet prices is indication producers are optimistic about the market recovery in the second half of the year. The pig industry has been looking forward to “rising” for a long time.

Sources tell us there have been widespread reports of disease (ASF and PRRS) outbreaks throughout China and especially in the north during the last quarter of 2023. The supply of piglets in places declined, and the industry’s expectations for the market in the third quarter of 2024 are the catalyst for rising piglet prices. Recently, Shennong Group reported purchasing a total of about 180,000 piglets from December 2023 to January 2024.

Where does the market go from here?

We believe sow liquidation is significantly greater than reported and the recent increased demand for weaned pigs and rising prices supports that belief. Public reports show sow inventory of 41.68 million head, but our sources suggest actual inventories of productive sows may be something much less (official inventory sow slaughter numbers December-December down 2.4 million). We look for prices to stabilize in the near term and return to profitability in the second half of the year.

Categorised in: Featured News, Global Markets

This post was written by Genesus