Mercedes Vega, General Director for Spain, Italy & Portugal

We have reached the end of the year, and it has indeed been a notably different year. From a production perspective:

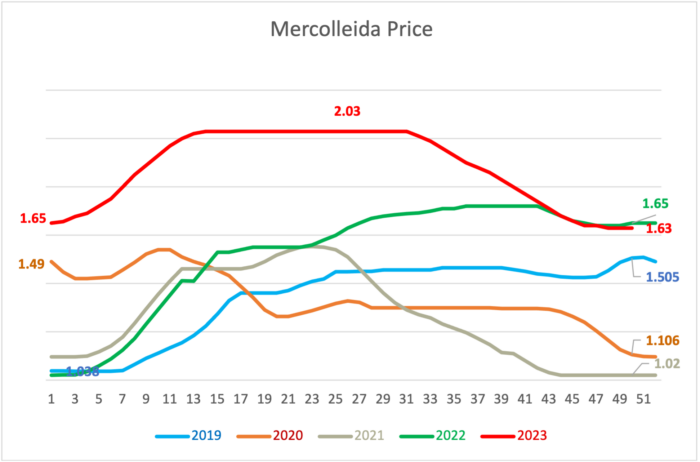

Price: We started 2023 with a value well above the past 10 years, at €1.65/kg live weight. Entering spring, we achieved an unprecedented price of €2.003/kg live weight, maintaining values above €2 for 19 weeks. While this week’s market is slightly below last year, it remains significantly above the last 10 years at €1.63/kg live weight.

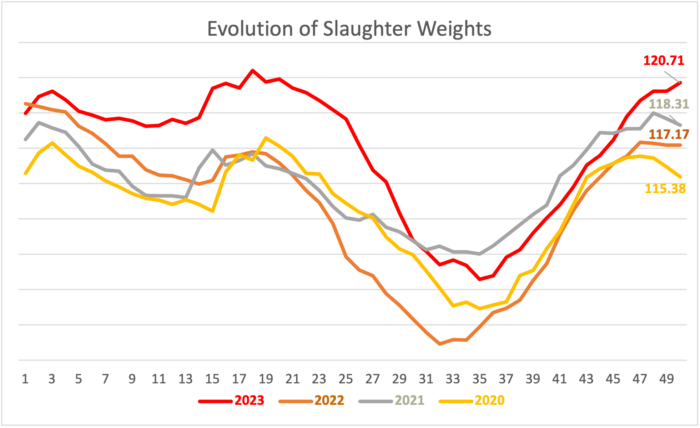

Weights: Year after year, there has been a consistent increase. Over the past decade, we have seen a rise from an average of 107.46 kg to the 2023 average of 116.97 kg.

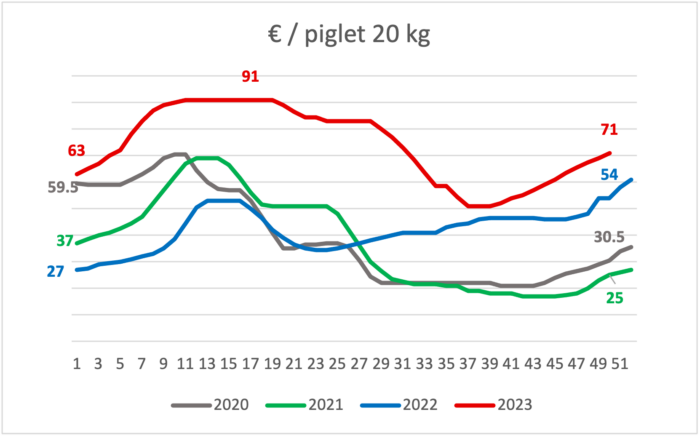

Piglet Prices: This year has also been exceptional in terms of piglet prices. The lack of production due to various factors, including health and legislative considerations, has resulted in piglet prices consistently exceeding those of previous years throughout the entire year.

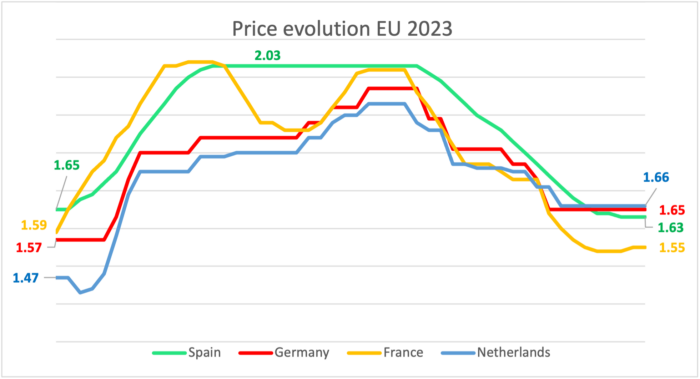

EU Prices: While Spain has maintained higher prices within the EU, the notable difference that existed before is no longer as pronounced.

- Census: Both Germany and the Netherlands continue to decrease their sow census. Meanwhile, in Spain, the provisional census from the Ministry of Agriculture, Fisheries, and Food (MAPA) as of May is 2,724,962 (2,394,033 white and 330,929 Iberian). The census has not decreased, although production has been significantly affected by viral processes that have not yet been effectively controlled, impacting companies and production areas differently. Additionally, there is an increase in the percentage of deaths due to the implementation of EU legislation.

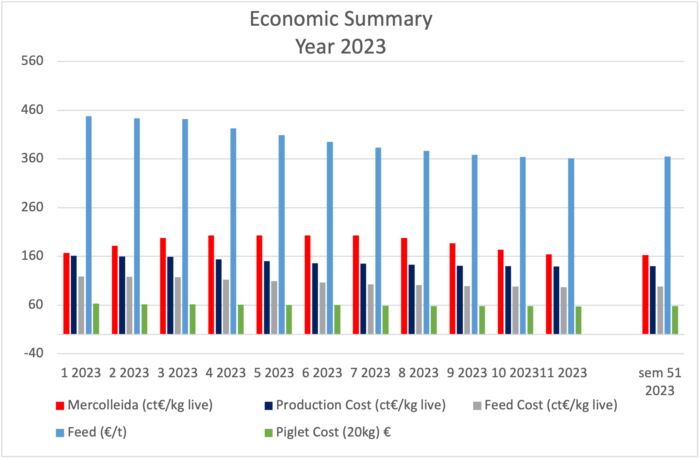

- Costs production: This year, the Pig Farming sector has experienced an excellent year, as indicated in the table based on data from SIP Consultors

However, these positive trends haven’t translated similarly from an industry perspective:

- Processed Pig: According to MAPA, processed pigs until July were 30,628,462, a 6.8% decrease compared to 2022, yielding 2,845,149 tons of meat. While there are fewer pigs, their increased weight compensates a little for the reduction.

- Selling Prices: The industry couldn’t pass on the higher purchase prices to the meat, leading some industries to close, while others are significantly impacted in their financial results.

- Exports: Exports have considerably decreased due to significant price differences between the EU and the US. ANPROGAPOR estimates a 6.5% reduction in total exports. Notably, there is a 15% decline in exports to China, which now constitutes 20% of our market. Losses have also occurred in other markets: Philippines (-39%), South Korea (-25%), and Japan (-12%). Export focus is shifting towards the European market, with a slightly higher value than third countries. Fifty-three percent of exports go to the European Union, and 47% to third countries.

In broad strokes, this is the situation as we conclude 2023. It’s evident that we are witnessing a paradigm shift in production that is not yet clearly defined. What is clear is that the industry is consolidating into fewer hands, though the exact business model for the pork supply chain remains uncertain.

Wishing everyone a Merry Christmas and a prosperous 2024!

Categorised in: Featured News, Global Markets

This post was written by Genesus