Mercedes Vega, General Director for Spain, Portugal and Italy

We have closed the year 2023 and certainly, its results have had nothing to do with those of 2022.

It has been an excellent year for production:

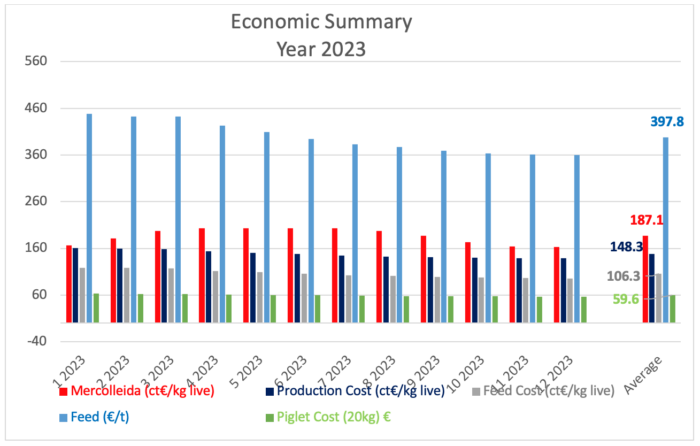

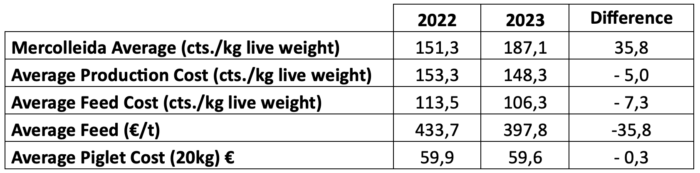

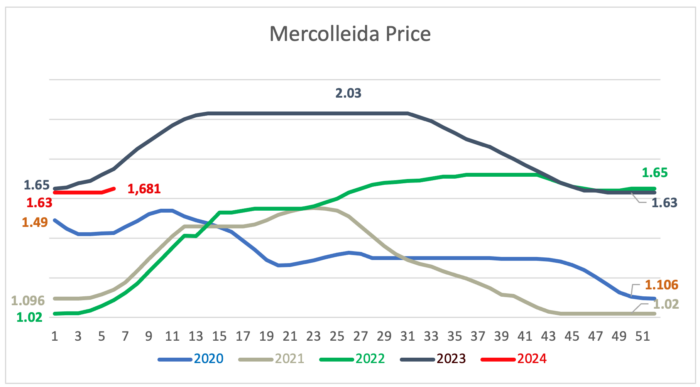

- We have had record values from Mercolleida with an average of €1,871/kg live weight compared to €1,513/kg live weight in 2022.

- According to data from SIP Consultors, the Average Production Cost has been €148.3/cts./kg live weight, with an average feed cost of €106.3/cts./kg live weight, compared to €153.3/cts./kg live weight production cost and €113.5/cts./kg live weight feed cost in 2022.

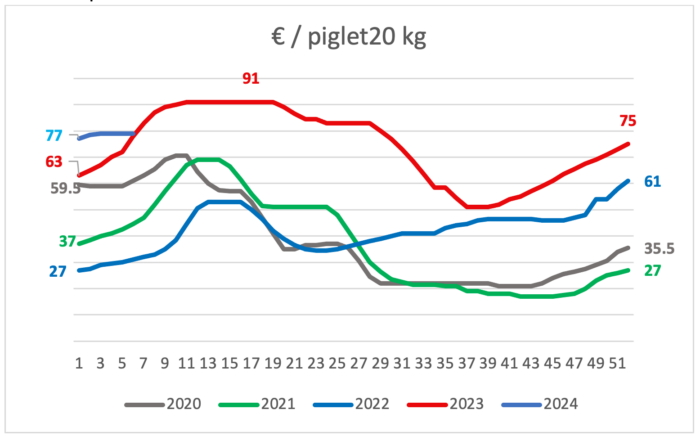

- The average production cost of a 20kg piglet, according to the same source, has not shown much difference in the last two years: €59.6 ($64.42 USD) versus €59.9 ($64.75 USD).

- This slight increase in the cost of the piglet is due to the existing health problems due to PRRS outbreaks and the increase in losses.

- But the sale price of this same piglet has had a great difference with an average Mercolleida value of €74.1 ($80.1 USD) in 2023 compared to €42.2 ($45.62 USD) in 2022. This difference is also strongly influenced by the decrease in production in the EU. Governments are encouraging the closure of farms. Both Germany and the Netherlands continue to reduce the sow herd. The consequence is a lack of piglets, some of which used to come to Spain.

However, it has not been the same for the industry:

- According to MAPA data up to November ’23, 5.54% fewer pigs have been processed than in the same period of 2022, 48,763,167 pigs compared to 51,623,046 pigs in the same period.

- It has been lost for many months and has taken some industries down.

- Exports: have decreased considerably due to the significant price differences between the EU and the US. According to data provided by ANPROGAPOR, a total reduction of 6.5% in our exports is estimated. Regarding markets, a 15% decrease in exports to China has occurred and now China represents 20% of our market; there has also been a loss of positioning in other markets: Philippines (-39%), South Korea (-25%), or Japan (-12%). Exports are increasing towards the European market with slightly higher value than to third countries. 53% of exports go to the European Union and 47% to third countries.

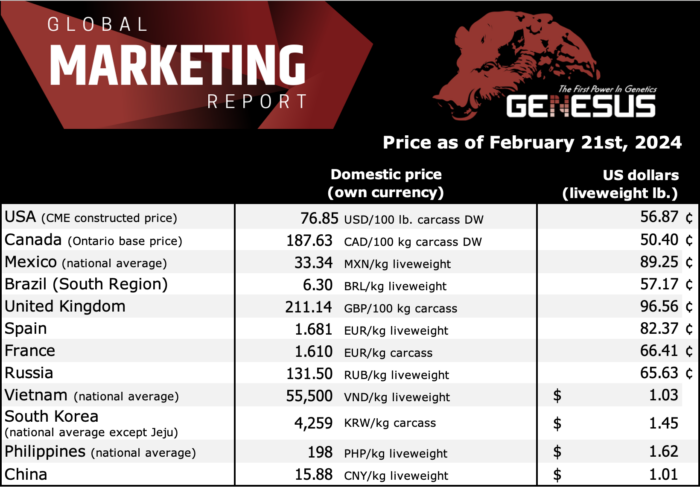

We have started this year a little below last year, but without a doubt well above the last 10 years. After 10 weeks of repetitions, this last one has increased, and not because producers and industry have agreed at the Mercolleida table, but because the board of directors had to do it. The price is at €1.681/kg live weight (82.37¢ USD liveweight/lb.), while in Germany, although it has increased, it is €1.65/kg live weight (80.85¢ USD liveweight/lb.), France €1.61/kg live weight (78.89¢ USD liveweight/lb.), and the Netherlands €1.63/kg live weight (79.87¢ USD liveweight/lb.).

The truth is that it is a bit complicated to predict how this new year that has just begun will go, it depends on too many factors that are not clear. What is evident is that the herd in the EU is decreasing, that in Spain production is becoming more concentrated, and the new EU regulations will affect production directly or indirectly. And with these elements, we will have to make the basket…

Categorised in: Featured News, Global Markets

This post was written by Genesus