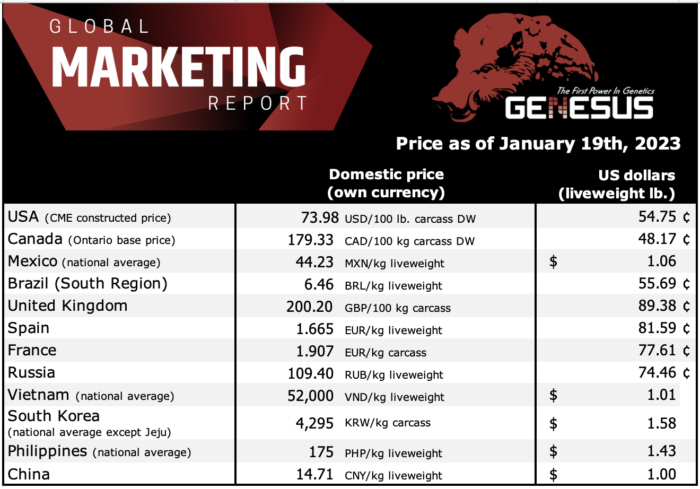

Mercedes Vega, General Director for Spain, Italy & Portugal

We have closed the year 2022 and the truth is that it has been an extremely complicated year in which unprecedented situations have arisen that we can remember:

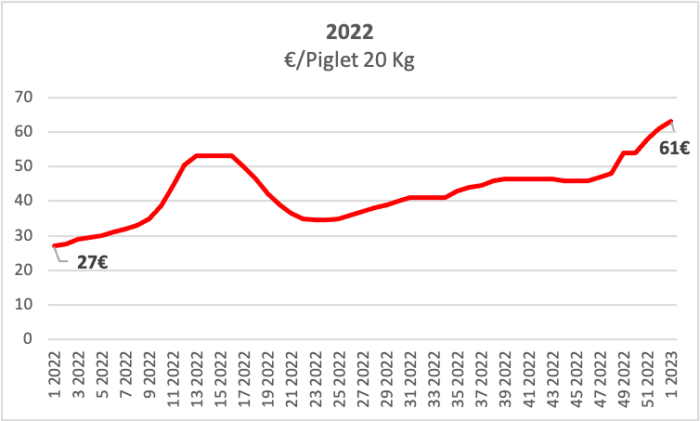

- The price of piglets at 20 kg from January to the end of the year has risen 226%, and this 2023 has started with a value of 63€ and this week it has risen again to 65€.

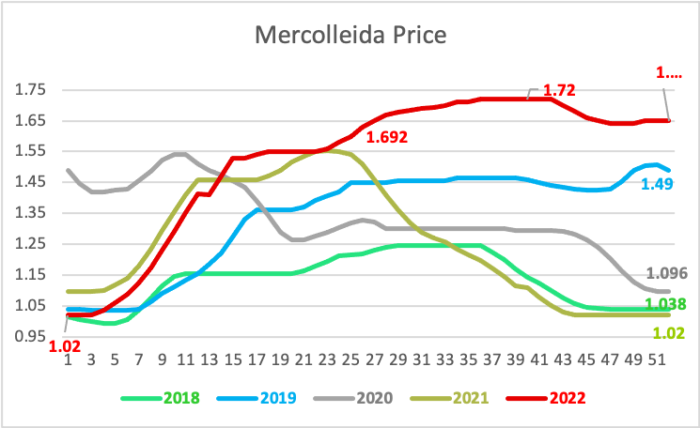

- Mercolleida’s price started January with the lowest value of the last 5 years at €1.02/kg LW and reached the highest at the end of the year, reaching the record price (€1.72/kg LW) in September. Starting this year at €1.65 and rising. In this third week of the year, we are at €1.677/kg LW. The average for 2022 has been 1.523 €/kg LW.

| €/kg LW | Spain | Germany | France | Netherland |

| Week 1 2022 | 1,02 | 0,95 | 1,12 | 0,91 |

| Week 1 2023 | 1,65 | 1,57 | 1,59 | 1,47 |

| Average 2022 | 1,52 | 1,40 | 1,51 | 1,33 |

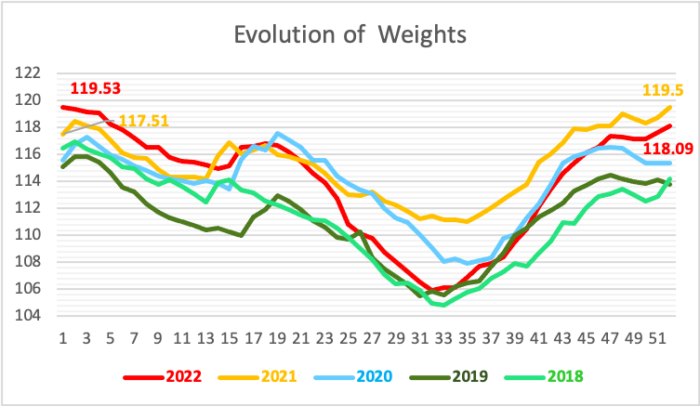

- The weights, we started with the highest of the last years 119.53 kg and we have finished, although a little below the year 2021, with almost the same weight, 118.09kg. The average for the year was 113.82 kg.

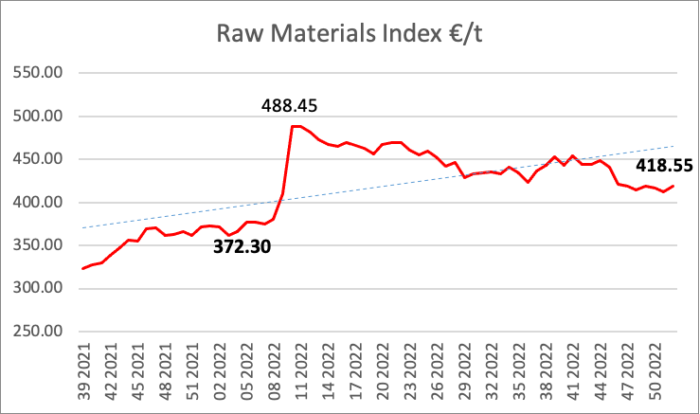

- Production costs are skyrocketing due to the worldwide repercussion of the increase in the price of raw materials. It seems that these are gradually decreasing, but the end of the year, according to the forecast of SIP Consultors, would be at 1.55 €/kg.

- Processed Hogs, according to data from the Ministry of Agriculture, Fisheries and Food until October 2022 there was a monthly average of 4,677,727 hogs compared to 4,771,664 hogs in 2021. What extrapolated to the year in 2022 has been 1.74% less than the previous year the equivalent of 1 million hogs less.

- Exports, with provisional data up to September 2022, the Spanish meat sector has been able to diversify, increasing exports in terms of sales value and recovering from the decline in China, thanks to the Philippines, Japan and South Korea. These represented 12.3% in volume and 14.5% in value up to September 2021, becoming 20.5% in volume and 21.7% in total value of exports in the same period of 2022.

| TOTAL SWINE SECTOR (Without live animals) | Jan-Sept 2021 (Prov.) | Jan-Sept 2021 (Prov.) | Variation % Jan-Sept 2022 (Prov.) vs Jan-Sept 2021 (Prov.) | |||

| Thousands Tons | Millions € | Thousands Tons | Millions € | Thousands Tons | Millions € | |

| China | 1057,8 | 2.343,50 | 485,3 | 1.075,90 | -54,10% | -54,10% |

| France | 219,2 | 603,2 | 219,5 | 657,9 | 0,10% | 9,10% |

| Philippines | 114,3 | 192,5 | 182 | 353,3 | 59,20% | 83,50% |

| Italy | 118,4 | 229 | 158,2 | 330,8 | 33,70% | 44,50% |

| Japan | 99,2 | 385,7 | 153,5 | 578,9 | 54,80% | 50,10% |

| South Korea | 70,3 | 267 | 111,2 | 358,1 | 58,10% | 34,10% |

| Total World | 2.301,2 | 5.842,0 | 2.174,9 | 5.949,7 | -5,5% | 1,8% |

This is what the year 2022 has given us, and it is with this impression that we start the year 2023.

We cannot leave aside that there are other factors that are also affecting the Spanish pig sector (and that of the EU) and that perhaps are not as visible as raw materials, energy costs, …, such as the very important repercussion that the European legislation on the use of antibiotics and zinc oxide is having on production, as well as the lack of qualified personnel, health, …

This brings us back to approach to the production. On the one hand, whether we should continue to produce the maximum number of weaned piglets per sow per year, even if this entails an increase in the cost of facilities, management, sow replacement, etc., or whether we are talking about hogs produced coming out the farm gate per sow present per year. Also, on the other hand, if we continue with a “commodity” product or have to start increasing the production of a quality product.

As always, crises generate opportunities. The current one, I believe is the most far-reaching crisis in living memory. I hope that, as in previous crises, the Spanish Pork Sector will be open to changes in concepts to continue leading as it has done so far in the market.

Categorised in: Featured News, Global Markets

This post was written by Genesus