Markets in Russia

Simon Grey, General Manager Russia, CIS and Europe, Genesus Inc.

Current Price in Russia is 102 Roubles ($1.77) per kg. Despite some increased production and increased imports from Brazil, consumer demand is increasing. When the Rouble crashed a few years ago, people spent their spare money on imported consumer goods ahead of price rises. They then for a period reduced spending. Today spending is increasing, particularly on food and meat. Russians are natural pork eaters so are buying more pig meat.

This welcome continuation of high price is of course good for pig producers. However, IT WILL NOT LAST FOR EVER. Sanctions are due to remain in place until the end of 2018 and new farms continue to be built. Any restrictions on trade are ultimately not good for any economy. All economies are driven by companies producing and trading goods and services.

Of course, when business is very profitable, getting companies to understand this reality is virtually impossible.

The only sure way to deal with lower sales price is to reduce cost of production. Russia will need to develop an export market, therefore needs to become globally competitive. This means competing on cost with North America and Brazil.

Europe is today an exporter, even with production costs 25% to 30% higher than North America. However, continued increase in (perceived) Animal Welfare rules will only increase costs and decrease production. Every country so far that has put in place strong animal welfare rules has succeeded in cutting pig production by 50%. Current moves in Germany, Holland and Denmark will most likely achieve this (history repeats). Eventually Europe will become a net importer of pig meat. The classic example is the UK. I last worked in the UK in 2000. At that time, the UK had 800,000 sows. Now it’s down to 400,000 and the UK imports 50% of its pig meat!

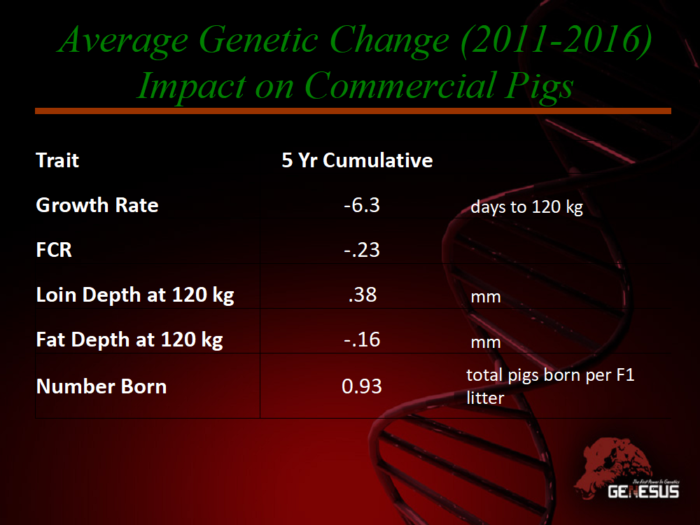

Genetics plays a vital part in driving down cost of production. International standard genetics not only maximises output, which is a major driver of cost, it also produces pigs capable of achieving slaughter weight eating less food every year!

Today alongside Genesus there are only 4 other global breeding companies remaining. Genesus sows are very capable of producing over 4 tonnes of live-weight per year.

Russia is very short of globally competitive genetics for its current herd size. The requirement for Nucleus is about 35,000 Dam-line and 6500 Sire-line sows.

What does globally competitive mean?

- Recently sourced from the Primary Genetic Nucleus of one of the 5 major breeding companies.

- Large population of an absolute minimum 400 Sire-line sows and 500 Dam-line sows.

- Recorded on a global genetic database that utilises BLUP

- Genetically linked to the original Primary Genetic Nucleus by boars or semen.

- Running very high replacement rates, well over 100% for both sows and boars.

- Testing a lot of pigs and using very high selection intensities.

- Access to genomic selection.

- Team of PhD Geneticist’.

- Links to the top universities and research institutes.

- Unbelievable computing power capable of processing the incredible amount of data required to run a successful breeding program (computer power is in fact today a limiting factor in genetics).

- Access to the multiple millions of $ required to undertake the work required.

- High health.

The reason there are only 5 global companies remaining today is that to be competitive cost A LOT of money! Genesus as a company spends over $5 million a year just on genomics. I am sure all readers of this can calculate the margin breeding companies make on an F1 gilt (the difference between slaughter price and F1 price. Readers will then be able to calculate the number of gilts that need to be sold, just to pay for genomics. There are of course a lot of other costs related to running an effective genetic company. It is therefore very clear why only the largest companies have the volume of sales to be competitive and get real genetic progress. Genetic progress is the annual improvement in performance achieved by breeding companies.

Genetic progress is the annual improvement in performance achieved by breeding companies.

This genetic progress is worth today in Russia about 200 Roubles per pig ($3.28). Assuming Russia’s sow population is 1.8 million sows then it is worth $130 to $150 million per year for the Russian pig industry. As its genetic progress then its per year EVERY YEAR!

A peculiarity of many Russian companies is the wish to be independent. This independence includes having their own genetics. Running breeding programs with small populations and without the proper tools is not effective. Yes, the replacement pigs produced may cost less money, but not getting genetic improvement costs many times more!

Like in many other parts of the world the decision to close herds is based upon the risk of introducing disease with replacement genetics. Of course, there are some risks, but with modern testing techniques and proper biosecurity these risks can be minimised. To offset the risk, we need to calculate the guaranteed loss from not getting genetic improvement

Independence is costing the Russian pig industry over $100,000,000 per year! When global competitiveness is required this money will be required!

Categorised in: Featured News, Global Markets

This post was written by Genesus