Fernando Ortiz-Hermida Genesus Ibero-America Business Development

Markets

The national prices of liveweight hog and pork carcass continue to contract week by week, these movements are due to a series of factors, such as the slow pace of national demand, higher weights in slaughtered animals and although international purchases have recently decreased at 2% weekly, the volume acquired reaches almost 179 thousand MT.

The national average price of pork once again contracted an average of 4.5% per week, settling at MX$30.01 per kilo (74 USD cents/lb approx.) liveweight.

If we would remove the state of Yucatan from this mathematical calculation (which is the highest and is practically operated by a single company), the Mexican national price would currently be around $28 MXP (69 USD cents/lb) liveweight.

However, and despite the low prices registered in the last months in Mexico, the average price of pork at the farm is 42.29% above the price paid in the US, while in the case of pork carcass the difference is 82.28% This is another reason why more pork comes to Mexico from the United States.

Mexico Pork Prices vs US Lean Hog Futures

Mexico Pork import

Mexico is third in the world importer of pork, and the first among Latin American countries.

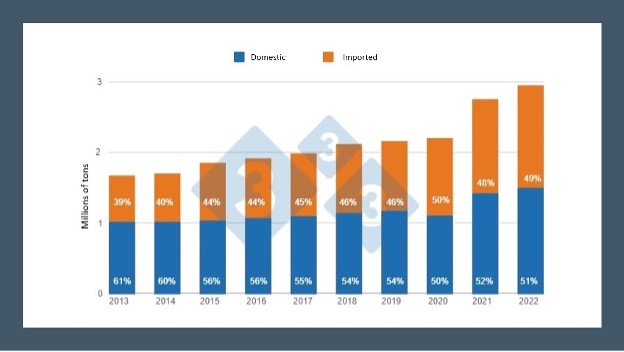

In 2022, Mexico’s pork consumption was made up of 51% domestic product, while 49% was imported pork. Now in 2013, the relationship was almost inverse 61% for domestically produced pork while only 39% was the share of imported pork.

Mexico is a significant market for U.S. pork exports, and is typically one of the top destinations for U.S. pork products. The U.S. pork industry benefits from Mexico’s growing demand for pork as a protein source, and Mexico benefits from the availability of high-quality U.S. pork products. The trade relationship between the two countries, despite being a double-edged sword, is important for both the U.S. and Mexican economies.

Pork sources for domestic consumption in the Mexican market

On the other hand, at the end of last March, OPORMEX mobilized more than 300 pig farmers from the states of Sonora, Jalisco, Michoacán and Querétaro to demonstrate in front of the Ministry of Economy to demand regulation of imported pork, which has flooded the national market and left out about 200 small and medium producers.

The president of the Organization of Mexican Pork Producers (OPORMEX), Heriberto Hernández, accused at that time that the opening to the foreign market with zero tariffs is causing the collapse of the domestic market, with prices paid to the producer well below the cost of production.

“Our concern is the dramatic collapse in the price of the Mexican pork. As of today, the sale price is between 22 and 23 pesos per kilogram (approx. 55 USD cents/lb) of live pigs, when our production costs range between 34 and 38 pesos/kg (approx. 88 USD cents/lb)” said the president of OPORMEX, adding that this situation is causing losses of between 1,200 and 1,600 pesos (approx. $77 USD) per pig produced.

Summary

- Since December, an oversupply in the global pork market, high production costs, a very strengthened Mexican peso, and a collapse in the Japanese pork market (the main destination for Mexican exports) among other factors, have made the Mexican pork industry lose competitiveness the in the international arena.

- The above factors have caused an oversupply in the domestic market.

- Almost half of the pork consumed in Mexico originates outside the country.

- 2023 has also brought greater business consolidation and consequently a reduction in small and medium-sized entrepreneurs in the Mexican pork industry.

- Productivity in Mexico has stagnated at 22 pigs weaned/sow/year while only 18 piglets/sow/year are sold.

- Diseases and sow mortality rates above 14%, due to sows that are not very resistant to the challenges of modern pig farming, continue to hit productivity hard in the Mexican swine industry.

Sources:

333

Porcicultura.com

Market Consultant Group

Categorised in: Featured News, Global Markets

This post was written by Genesus