Fernando Ortiz – Ibero-America Business Development Genesus

Mexico last four years pork market

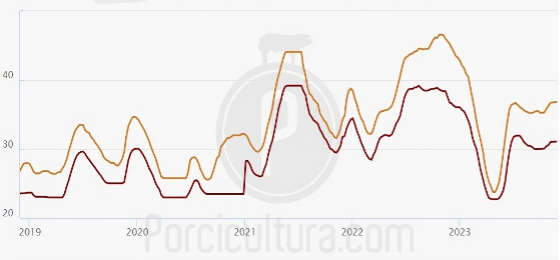

Taking a more in-depth look at the profit margins for producers over the last 4 years, that is, the pre-pandemic, pandemic, and post-pandemic period, what we currently see is a rearrangement of prices determined by a more stable market, with necessary adjustments, when comparing feed costs vs. liveweight pig prices into the market.

What I mean by this is that, after historical strong spikes on the ceiling and the floor, the dust has begun to settle as supply and demand for both commodities trending downward and pork curving in the opposite direction, but both going in the right path. Pork prices settle into the high mid-thirties (Mexican pesos/kg) or $0.97 to $1.00 US/lb.

The following is a graph referring to pork prices in the last 4 years for two representative states in pork production, Jalisco (yellow line) and Sonora (red line). Liveweight prices on the left are in Mexican pesos per kg.

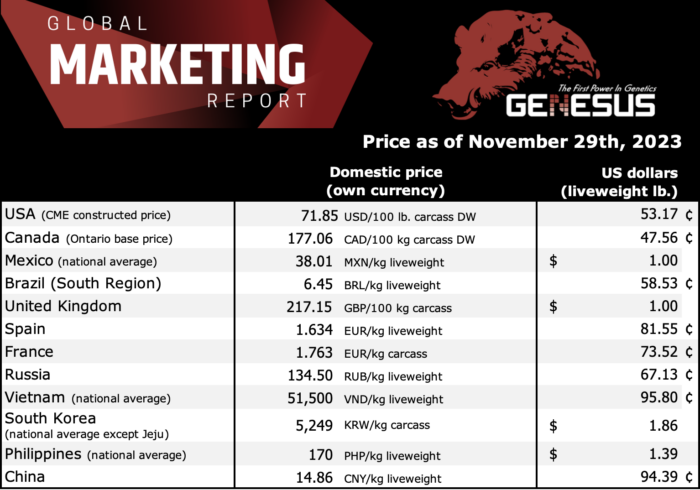

Prices

The national average liveweight price as of November 27 remains stable at 38.01 MXP/kg (approx. US$1.00/lb). The national price remains strong due to a lower supply of domestic pork.

As a comparative data, the national average price of liveweight Mexican hogs is 76.90% higher than the price paid in the USA, while in the case of carcass the difference is 127.93%.

A general look at the current pork industry in Mexico

In the first 10 months of 2023, can be summarized as follows:

- Pork production has increased by 2.5%, from 1,262,000 tons to 1,300,000 tons.

- Imports have risen 3.9% from 1,114,000 tons to 1,158,000 tons. It must be remembered that Mexico imports 41% of total American pork exports.

- Exports, on the other hand, have fallen 13.2% (both items have been impacted by the exchange rate of the Mexican currency, which is very strong against the USD)

The previous figures give us, as well, an idea of the demand in Mexican domestic consumption.

- Speaking with various pig farmers, they report to us that the liquidation of the national herd so far this year could be around 15%, that is, about 150,000 fewer sows.

Sources

GCMA Agricultural Market Consulting Group

OPORMEX

Porcicultura.com

Categorised in: Featured News, Global Markets

This post was written by Genesus