Mercedes Vega, General Director for Spain, Italy & Portugal

The European pig market is experiencing an unusual situation at the end of 2019.

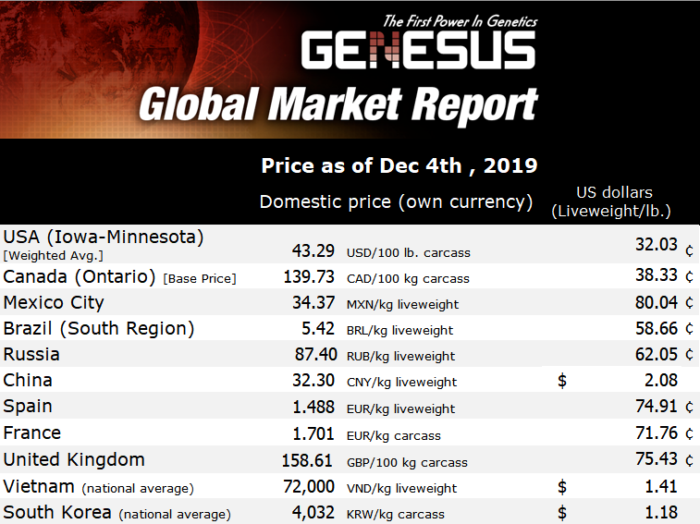

Spain has the lowest price of all major European producers. Even so, they are at € 1,488/kg (74.91¢ US/lb) liveweight, far from the € 1,038/kg (52.96¢ US/lb) liveweight of a year ago. W also continue to see heavier market weights than last year – 114.19 kg compared to the 113.31 kg of 2018 same week.

More hogs, more weight and price continue to rise – this can only be a response to a very strong demand. Producers are in no hurry to sell and recover hogs’ weight.

A European leader in pig production, Spain is increasing pig inventory and processing volume. This November, although no official figures yet released, there has been record activity in the processing plants.

Besides record high prices for market hogs, which reflects the current market moment, we observe a strong wean pig price and record Cull sow price.

- € 55/piglet or $61 US (reference price) compared to € 35/piglet or $39 US a year ago.

- € 0.880/kg (44.30¢ US/lb) liveweight for Cull sows compared to € 0.460 (23.16¢ US/lb) a year ago.

Spain is the No. 1 EU exporter and the world’s largest supplier of pork for China. Production is going up in Spain while Germany and Denmark are going down.

With all these premises Spanish producers are at their best, the exporting industry also. The only ones that are having it more complicated are businesses in the processing industry. Its raw material is at record high price and it is still not clear how will this impact end-product prices.

More and more Spanish processing plants are authorized to export to China, and new opportunities are at rise for products such as: bone ham, sausages, pepperoni and loin. Until last October, only boneless hams from Spain could enter China. Although the authorization protocol was signed a year ago, during the visit of the Chinese president, Xi Jinping, to Spain. it has not been until early October this year when all the procedures necessary for export have been completed.

This opens new opportunities for Spanish pork products in a high quality niche market. Since Spain has the pork, the knowledge and ability to make end-products with high added value; changing from that current “commodity” to a niche market will encourage them to offer and strengthen high quality products.

FISP 2019, VI INTERNATIONAL SWINE SECTOR FORUM

Last week, November 27, the “VI International Forum of the Porcine sector” organized by INTERPORC took place in Madrid, with the motto “The future, our present”. This annual event brings together all the pig value chain representatives.

There were many interesting presentations, such as that of its director, Alberto Herrranz, in which he addressed the need to better communicate with the wide public about “the work and efforts the pig industry makes in matters such as: environmental improvement, animal welfare or innovation, among other aspects that concern the today’s society”…“therefore intensifying our communication is a challenge to face as a priority for the entire sector ”.

Another well received topic was that of José Miguel Mulet, Professor of Biotechnology at the Polytechnic University of Valencia, on defending the activity in the pig sector as a tool against rural depopulation.

Madrid COP25MADRID Climate Summit

On the other hand, and how

could it be otherwise, the Spanish Pork Sector is also focused of the

activities of the Climate Week taking place in December.

Officially Releases:

- Spain’s greenhouse gas emission:

- Beef – 3.5%

- Swine industry – 1.9%

- Seep and goat industry – 1.1%

- Cuniculture – 0.02%

- More than 2 million people work in the meat industry.

- The role of livestock in the conservation of ecosystems such as pastures or mountain areas

- The meat sector reaffirms its commitment to sustainability and the environment

Categorised in: Featured News, Global Markets

This post was written by Genesus