Jim Long, President-CEO, Genesus Inc.

March USDA Hog and Pigs Report

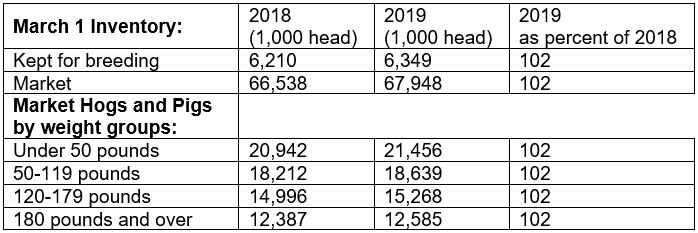

No real surprises in the March USDA Hogs and Pigs report. The Breeding Herd has been running about 2% more year over year for a few reports so you could expect 2% more pigs coming from that.

December- February litter size 10.7 up 1% from a year ago (10.58)

December – February Sows farrowing 3,084 up 2% from a year ago (3,034)

Everything seems to be 2%?

Since last June the U.S. breeding herd has increased 29,000 or less than ½ of 1% (6,320-6,349). A reflection in our opinion to the challenge of pig production profitability over that time frame.

Other Observations

U.S. Lean Hog prices 53-54% have jumped considerably in last 4 weeks, going from 51.85₵ lb. to 73.47₵. A jump of over $45 a head. Went from losing money to making money. It wasn’t anytime soon enough.

A year ago 53-54% Lean hogs were 57.80₵ lb. now 73.47₵ lb. For many weeks we were below year ago prices by a considerable amount, now the pendulum has swung.

Lean Hog Futures have been on a wild ride. Going rapidly up, then a quick fall. A Future traders dream, lots of trades, lots of fees i.e. Friday- June Futures gyrated in a 5₵ window. It took the future market 6 months to realize China will have an unprecedented pork shortfall. So much for market intelligence. In our opinion hog prices will continue to rise. As my old friend Doug Maus used to say “Chicago! Las Vegas with no rules”.

China

“Chinese Pig Farmers have culled at least 10 million pigs to stop the spread of the disease, according to the most recent estimate from the market-data firm INTL FCSTONE, and hog production is running roughly 30% below last year’s levels. That could mean China’s production falling by over 200 million hogs this year from 710 million last year according to the U.S. Department of Agriculture”.

Wall Street Journal Article – ASF Article – Jacob Bunge – March 27, 2019

200 million fewer hogs! That’s more than the combined production of the 2nd and 3rd largest hog producing countries. U.S.A. (127 million) Spain (50 million).

In 2014 the U.S. and Europe had their highest prices ever, mostly triggered by the PED outbreak in the USA that lead to the loss of 7-8 million pigs. Now USDA speculating 200 million in China? ASF is now in Viet Nam- if it acts like China, there could be a reduction of 10 million more market hogs a year.

Let’s say 200 million less market hogs if USDA correct. That’s about 65 million tonnes of feed not needed. That’s corn not needed; 2 billion bushels? Soymeal? Canola? It’s like USA hog industry disappeared. China is near self-sufficiency for corn, do they export? Not exactly bullish grains or oilseeds is it?

China Hog Prices March 30

Lowest Price: Guangxi – 13.1 Yuan kg (88₵ U.S. Liveweight a lb.)

Highest Price Sichuan and Zhejiang – 17.1 Yuan/kg. ($1.15 U.S. liveweight a lb.)

Average price – Country – 14.84 Yuan/KG ($1.00 U.S. liveweight a lb.)

Certainly can see location matters in China. $70 U.S. per head difference from low to high. We expect Chinas average price will continue to rise probably exceeding $1.30 U.S. a lb. at some point.

Categorised in: Featured News, Pork Commentary

This post was written by Genesus