No doubt the World likes Meat

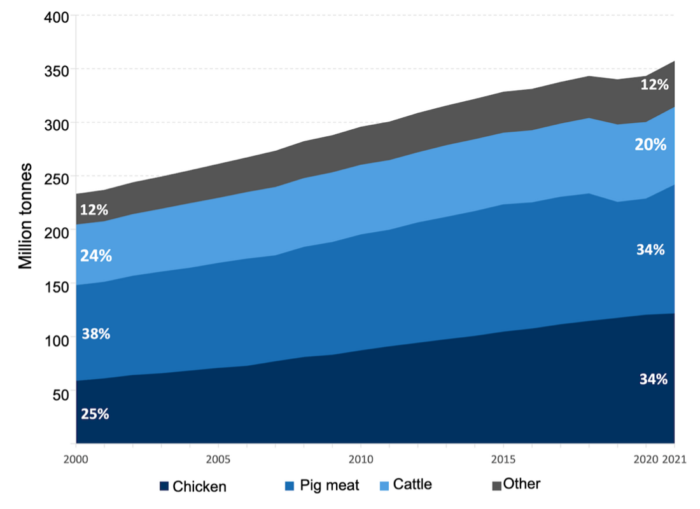

Below is a graph from FAO – Pig 333 that clearly shows the global increase in meat production over the last twenty years.

2021 is up 53% from 2020 or 124 million tonnes. No doubt the world seems far from becoming vegetarian. The challenge is can North American pork industry produce pork for a profit? Pork has also lost market share (-4%) over the last two decades to chicken despite increasing pork production.

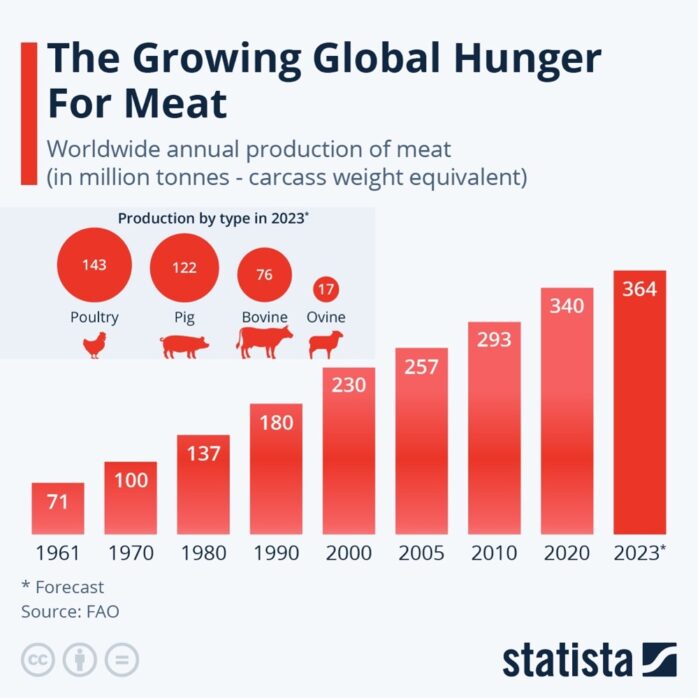

The following chart indicates Global Meat and Pork supply since 1961. The ever-increasing production indicates a growing market. Pork production in 2023 of 122 million tonnes is almost as great as all the meat produced in 1990.

All the data indicates the world continuing to eat more meat and pork. The challenge for pork is how to capture a bigger share of the ever-increasing demand and get it done for a profit. We believe one of the keys to market share is to deliver to consumers what they indicate the number one desire “taste and flavor”.

Our observation from doing business around the world is pork taste preference is the same everywhere. There are no different taste niches.

Market

The hog market had its usual Thanksgiving hangover last week with hog prices down around 73¢ lean average. If we use 92¢ lb. cost of production farrow to finish our farmer arithmetic tells us about a $40 per head loss. Lean Hog Futures last Friday closed Dec 68.60, Feb 70.100, April 76.37, May 83.77, June 92.22. If breakeven is around 90¢ lb. it doesn’t take a computer to project significant ongoing losses. Current lean hog future values certainly don’t indicate a profit hedging opportunity.

Not sure hope is a business strategy, but we continue to believe that there was significant sow herd liquidation that started in May which will bring fewer hogs to market in February – March and then ongoing. This would be supportive for hog prices.

Global

Supply of pork in Europe continues to run about 8% lower year over year. In China losses of $30 to $50 per head continues with some of the pig production companies share values reaching lows not seen for several years. Financial losses always lead to less production. We expect lower pork production globally in 2023. When you look at the historical rise of pork production globally over the last five decades fewer years have seen a decline. 2024 with less pork globally will lead to stronger prices.

Categorised in: Featured News, Pork Commentary

This post was written by Genesus