USDA Confuses U.S.

The December 1 USDA Hogs and Pigs Report indicated the market hog inventory at 66.966 million, a year ago 68.321 million. A 2% decrease year over year.

After seeing the 2% decline in inventory it was a surprise to us when we read the U.S. government’s quarterly Animal Product Production Report released last week.

| Pork Million Pounds | |||

| 2022 | 2023 | 2023 as % of 2022 | |

| Quarter 1 | 6904 | 7040 | +2% |

| Quarter 2 | 6639 | 6575 | -1.4% |

| Quarter 3 | 6533 | 6650 | +1% |

| Quarter 4 | 6920 | 7215 | +4% |

| Total | 26966 | 27480 | +2% |

Abracadabra – with a USDA report inventory of 2% less than a year ago, the USDA product report predicts 2% more pork in 2023.

You really wonder if USDA communicates within itself. There is absolutely no way the U.S. will have 4% more pork in the fourth quarter of 2023 compared to 2022. There is no scenario in the economics of this market that will lead one to believe in a 4% expansion. Negative producer margins, building costs, feed prices, labor issues, and the integrated model of owning pigs and slaughtering have been in the negative. We hear of capital calls and capital infusions to cover producer–packer integrated losses. This in no way leads to more hogs.

Now that we question the U.S. Animal Product report, we still show their predictions for Beef – Total Red Meat.

| Million Pounds | |||

| Beef | Pork | Red Meat | |

| 2021 | 27948 | 27675 | 55815 |

| 2022 | 28302 | 26996 | 55482 |

| 2023 | 26445 | 27480 | 54108 |

USDA projects U.S. Beef Production to decline by almost 1.8 billion lbs. in 2023 compared to 2022. Total Red Meat production (including our belief Pork is overestimated) down about 1.4 billion lbs. in 2023. USDA predicts steers to be $1.58 lb. avg. in 2023 compared to $1.44 in 2022. Hogs 2022 71¢ lb. 2023 68¢ lb. To us seems strange with 1.4 billion lbs. less beef the hog price of the other red meat would be lower year over year.

The main takeaway to us is less beef for sure, we would bet less pork. Total Red Meat production is down. Less supply in a U.S. population that grows every year. We expect exports to steady. To us, a scenario of strong prices as moving forward into 2023.

Other Observations

- Between holiday closures and bad weather, the U.S. hog slaughter was cut back the prior three weeks. This past week U.S. hog marketing’s roared back 2.688 million head, the week before 2.296 million, and last year 2.367 million. The big kill last week shows packer demand and supply. It will be interesting the next couple of weeks where slaughter numbers and hog weights go. Weights have jumped all over the last three weeks as slaughter numbers slowed.

- Last week we highlighted the MIT article on GMO – Gene Editing. The article discussed the challenge of developing GMO – Gene Edited PRRS resistance pigs. The real concern will be if Retailers – Food Service – Importers buy the product. Consumer resistance hurting demand. One customer China ended all Paylean use – a legal product. What happens if one customer does the same with GMO – Gene Editing? With Paylean you stop immediately. What do you do if the market evaporates for a herd of GMO – Gene Edited pigs? Will the company who sold them to you compensate the loss? Quote, “I knew it was too good to be true, but I believed anyway.”

An article by the renowned MIT Technology Review (Massachusetts Institute of Technology) reports on PIC Gene Editing. An interesting part of the article on GMO-Gene Editing – PRRS.

“In experiments on pig cells, the Genus (PIC) researchers have tried many possible edits to the CD163 gene, looking for those that occur most predictably. Even with such efforts, the pigs being born have the right edit only about 20 to 30% of the time.”

Link to the full article:

https://www.technologyreview.com/2020/12/11/1013176/crispr-pigs-prrs-cd163-genus/

U.S. Carcass Cut Out

Last Friday

Pork Carcass Cut-out 81.64 lb.

Beef Choice Carcass Cut-out 2.78 lb.

Seems to us a huge spread between Beef and Pork Carcass prices. Beef is 3.4 times the price of Pork.

This tells us that consumers obviously will pay more for Beef. As a Pork Industry, we need to ask why. Obviously, consumers have the money to pay for the Beef, they are voting for Beef with their money. We expect the reason Beef sells for more is the eating satisfaction (taste) Beef has. On the flip side, the big discount Pork to Beef is a reflection of lower consumer demand.

If we are going to prosper as an industry, we need to figure out how to compete with Beef and pull our prices higher.

As many of you, regular readers know Genesus has worked diligently to produce Genetics with better taste. We can report seeing higher prices for better-tasting pork, consumers will pay for it, but it has to be better not just a story. We are seeing it in North America, Europe, and Asia. In some retail situations over $2 lb. premium to commodity pork. We need to make the pie bigger through a better product so everyone has a chance to get a bigger slice of that pie. Moving cut-outs to $1.20 is a lot better business than 81¢. We don’t think we will increase consumption and demand without an industry move to consistently better-tasting pork.

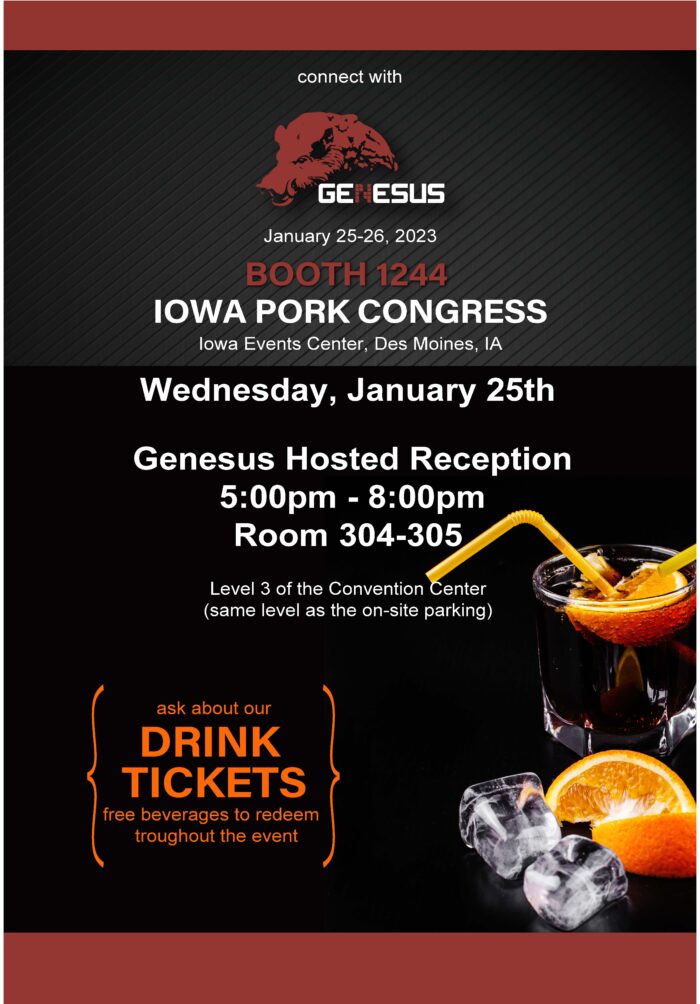

Next week we will be at the Iowa Pork Congress – visit us at Booth 1244 and or join us at the Genesus Reception on Wednesday evening.

Categorised in: Featured News, Pork Commentary

This post was written by Genesus