U.S. Record Corn Crop

Last week the USDA released their current estimate of this year’s corn crop, 15.234 billion bushels eclipsing the prior record in 2016 of 15.148 billion bushels. On Friday the U.S. average cash corn price was $4.39 bushel. $4.39 is the lowest price since early 2021 and a lot lower than the $8.00 bushel seen in the spring of 2022.

As we talk to people across the Midwest, most are pleased with their yields. Many saying it’s at record levels for them. Lots of stories of traditional storage facilities full and corn being piled outside with no other storage options. No doubt a huge crop. For hog producers after paying big prices for corn the last couple years a positive step in lowering cost of production. Farmer Arithmetic – If you use 10 bushels of corn as a measurement to raise a hog, every 10¢ decline lowers cost of production by $1.00 per head. The extreme $8.00 bushel to $4.39 now would be a $36 decline per head. Real Money.

In 2016-17 crop year with the prior record corn production, the average price was $3.65. The current $4.39 is still significantly higher. It will be interesting when the corn demand will come from with Brazil having significantly larger crops now than in 2016 to compete with the world markets.

High feed costs the last two years have been devastating financially for many swine producers. If you grow corn and feed to hogs, put manure on crop land the whole farm income was okay. Unfortunately, about 80% of all hogs raised by people who don’t grow grain. The high feed prices have led to big losses in many scenarios. All you have to do is look at publicly traded swine companies and calculate an estimated loss per head of over $30.

We use the terms regularly of “surest cure to high prices is high prices” and “surest cure for low prices is low prices.”

In our opinion high corn prices has encouraged greater production in the U.S. and the world. The USDA projects world corn production of 1,220,000 metric tonnes or just over 48 billion bushels. Prior to the U.S. corn ethanol program mandates which spiked U.S. and global grain prices world corn production was much lower.

2009 – 32 million bushels

2010 – 33 million bushels

2011 – 35 million bushels

There was never a 40-million-bushel world crop until 2013, after Brazil, Argentina, Russia, Ukraine etc. all increased acreage plantings and began more intensive crop production driven by higher prices and opportunity. From what we can observe in many countries outside USA – Canada – Europe lower land costs and arable land availability are encouraging ever more acres to come into production. We don’t see anything but a steady increase in world corn production as more acres, better hybrids, better technologies push yields higher = more acres x higher yields = more corn. Farmer Arithmetic.

A producer talked to us the other day of the frustration of observing corn producers relative to hogs. Hogs 365-day responsibility, large capital outlay very little government support. Corn farmers busy a few weeks in spring a few weeks in fall, government support and Arizona in winter. Sounds petty but a feeling of many hog farmers.

Better Tasting Pork

We believe for as an industry to push pork demand we need to produce better tasting pork. Below is an excerpt of an article by Patrick Fleming a pork industry veteran on the opportunity from better tasting pork.

“Retailers and packers – it’s time to bifurcate the pork selection in the meat case. Pork can bring in more dollars, but only if consumers have more options. If we’re only offering up commodity pork to our customers, we can only sell them commodity pork. But according to our research, consumers are ready for branded, differentiated pork options.”

Link to the full article: https://midanmarketing.com/blog/its-about-to-be-porks-big-moment-dont-mess-it-up/

Finishing Mortality

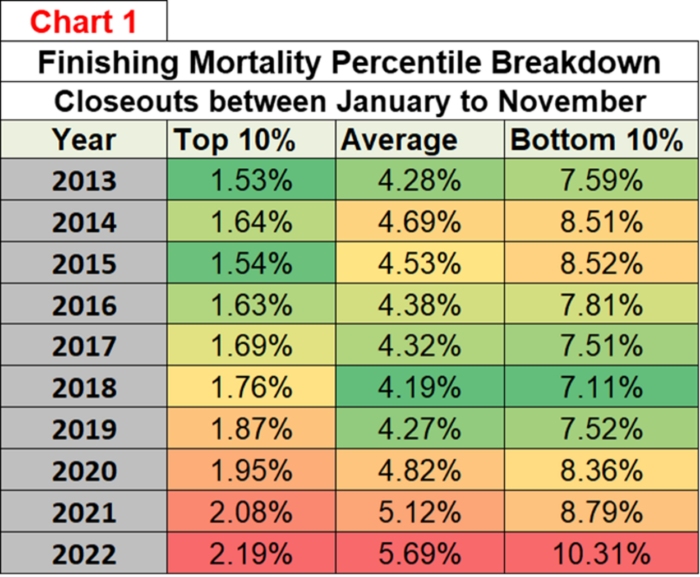

This past week Allan Bentley, Genesus Sales and Technical Manager who is based in Nebraska highlighted a huge issue in our industry. Allan has been with Genesus over 10 years and prior to those 20 years with Tyson. In this time, he has got to know many producers and seen their changes in our industry. Unfortunately, one of the changes Allan highlighted is the creeping increase of finishing barn mortality. A real leaker of profits. The chart below puts the facts to it.

In our opinion part of the creeping mortality is from evolving genetics towards lower appetite pigs. It’s a genetic philosophy we at Genesus don’t believe in, you need pigs that eat to fend of disease challenges. Most of us don’t like pulling dead pigs, it’s not a nice job and every dead is just an economic loss. Pigs need to eat to live.

Categorised in: Featured News, Pork Commentary

This post was written by Genesus