USDA Hogs and Pigs Report

More Pigs!

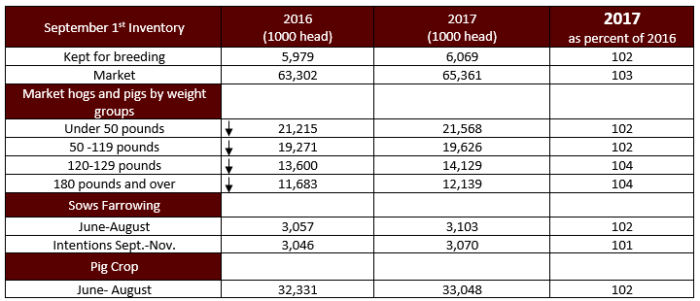

Last week the USDA released the September Hogs and Pigs Report. There were no surprises. There was expected of an increase in market inventory and there was 3% from last year.

The breeding herd is up 2% from last September, but what’s interesting is the breeding herd last December 1st was 6,090 while this September 1st was 6,087. Obviously, no change over the last nine months. As we wrote last week, the US sow slaughter is running significantly higher this year to date over last year. Our feeling has been these numbers meaning was insignificant, if any, in breeding herd expansion. Seems to be true so far, with current cost hogs’ basis in the US running between 15-30 per head, we expect little incentive or passion for sow herd expansion in the near term.

The September 1st Market hog inventory has increased year over year 1.7 million head. Assuming 25 weeks from birth to market (deduct sow mortality) and we came up with about 65,000 more hogs a week for the next six months. Currently new packing capacity is adding about 20,000 head more a day compared to a year ago (2016- 442,000; 2017-462,000)

Over the coming weeks as new plants continue to ramp up, we expect to see daily capacity exceeding 475,000 per day (150,000 increase per week). Packing Capacity will not be an issue.

The real challenge is profit margins or lack of, for producers. Losses per hog, of between $15-30, stand in stark contrast to what one packer indicated last week to us; that their packer margin was in the $40 range. These packer margins and their many months achieved are the envy of packers around the world. The good thing is Pork Cut Outs still are in to 70c range, meaning Pork demand remains vibrant.

These packers ranges continue to encourage more packer expansion with Prestage Farms, owner’s of well over 150,000 sows having started construction of their own new plant. Prestage Farms currently doesn’t have a packing plant.

We noticed one thing interesting last week, in that US daily hog market weights were lower thsn the week before. It will be interesting if we see lower hog weights this fall as weekly marketing increase from larger packer capacity. It will be something to watch.

This week we will be at Golden Autumn Agricultural Exposition in Moscow Russia, next week we will report our observations on the Russia swine industry and Golden Autumn.

BACKGROUNDER

Genomic Applications Partnership Program

Funded Projects – Round 7

The Genomic Applications Partnership Program (GAPP) funds translational research and development projects that address real-world challenges and opportunities as identified by industry, government, not-for-profits, and other “receptors” of genomics knowledge and technology. The following five projects have been selected for funding in Round 7 of GAPP, for a total investment of $17 million ($6 million from Genome Canada and $11 million from co-funding partners including provincial governments, private sector and not-for-profit organizations). Backgrounders on previous projects funded under the program are available on Genome Canada’s website.

Development of Genomic Crossbred Estimate Breeding Values (GCEBV) to maximize profitability for Canadian pork producers

Project leaders:

- Robert Kemp, Genesus Inc. (receptor);

- Graham Plastow, University of Alberta (academic)

Genome Centre: Genome Alberta

Total funding: $3.4 million

Pork producers in Canada buy their breeding stock and genetic material from pig genetic companies such as Genesus Inc. Their profitability, as well as that of Genesus, depends on the ability to create and transfer genetic improvements from the nucleus purebred population to commercial crossbred animals. Presently, the selection of desirable purebred animals is done using Estimated Breeding Values (EBVs), a measure of presumed genetic fitness that incorporates phenotypes and pedigree information of the animals. However, with EBV tools, only about 70 percent of the genetic improvement transfers to commercial crossbred animals.

Genesus is working with Dr. Graham Plastow of the University of Alberta to develop and validate GCEBV, or Genomic Crossbred Estimate Breeding Values. Adding genomics to the EBV selection tool is expected to increase the accuracy of the EBV tool by 20 percent. Further, adding phenotypes and genotypes of commercial crossbred animals will increase genetic improvement by another 30 per cent, for a total increase of 50 percent improvement in the transfer of genetic improvements to commercial producers. A successful project will increase Genesus’ competitiveness while having an economic impact on the industry of $17.25 million per year within five years of project completion. In addition, improvement in the feed conversion ratio of pigs because of the genetic improvements would reduce the land footprint of pork production, releasing more land for human food production.

Categorised in: Featured News, Pork Commentary

This post was written by Genesus