Pork Commentary, September 30th,

2019

Jim Long, President-CEO, Genesus Inc.

More Pigs Than Ever

September 1st U.S.D.A Hogs and Pigs Report

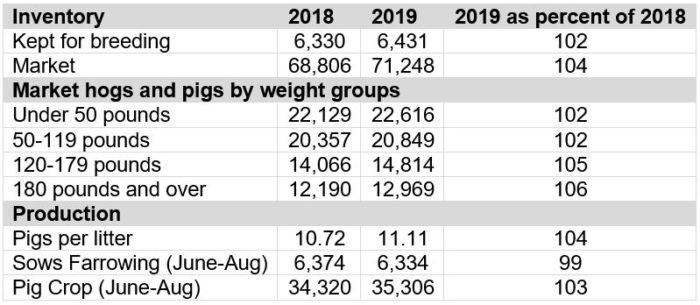

September 1st (x 1,000 head)

The U.S.D.A. inventory of market hogs on September 1st has set a new record for market hogs in U.S. inventory. The litter size of 11.11 is also a new record. No doubt no shortage of pigs.

A couple points – the under 50 lb. category is only 2% higher than a year ago and it’s interesting that less sows farrowed last quarter compared to a year ago despite a larger breeding herd.

We expect the lower farrowing numbers (-1%) despite the larger breeding herd (+2%) is due to the chlamydia problems that have spread in gilts sold to producers. The problem has impacted gilts not coming into heat affecting farrowing rate of the total breeding herd. It’s a perverse form of supply management using chlamydia gilts to cut production.

If we take the Pig Crop over the last 12 months (Sept. 1st to Aug. 31st) of 136,987 million and divide by 6,320 million kept for breeding (as of Sept 1st 2018), it’s 21.67 pigs per breeding kept.

An interesting number of 21.67. Bell curve it and it’s not hard to see not many herds getting 30 pigs despite coffee shop talk.

The litter size increase to 11.11 is in our opinion been aided by the relative quiet disease front. We do not believe the instances of PRRS has been as great as in some other times in USA.

The breeding herd gained 21,000 from June 1st; an increase but not of great significance.

In our opinion the U.S. breeding herd will see only incremental increases in the near future, as a reflection of the lack of current profitability.

The Sept. 1st, U.S. market hog inventory increased 2.5 million head year over year. A significant number. The billion dollar question is pork exports. The U.S. inventory is up 2.5 million – Chinese is down in the 200 million head range. Quite the difference. The ASF issue is real.

Other ASF related news

The current price of hogs in China are three to four times the U.S. price. China’s sow inventory continues to fall. The dog has not hit the end of the chain.

This past week we were with the largest producer in Viet Nam. They believe that Viet Nam herd has declined 50%. That means about 1.5 million sows gone. Now breaks in Korea and Philippines. Both about 1 million sow countries.

Europe

Last week Euro Stats released E.U. pork production results for first six months of 2019. Pork Production is down by 1.4% at 12.52 million tonnes.

Some country by country results

(2019 compared to 2018)

A decrease of 1.4% is about 180 million tonnes less pork. In our farmer arithmetic that’s equivalency of 1.8 million market hogs.

Further farmer arithmetic tells us that the 1.8 million decrease is close to the 2.5 million increase in U.S. Further farmer reasoning- U.S. up about what E.U. is down.

Spanish Visitors at Genesus

Last week we were with most, if not all of largest Spanish pig producers who were brought by Zoetis to Genesus for Genetic presentations and Farm tours.

Spain is the only significant scaled country increasing pig production in Europe. They have become the largest exporter to China. Hog prices in Spain are now 1.465 Euro/kg (73₵ lb. U.S. liveweight) with profits over $25 per head.

Spain’s production model is one of integrated contracting, unlike the rest of Europe that is primarily owner operators.

Our Spanish guests were positive of the future. They have been successfully growing their industry by capturing more and more export markets in Europe and Asia. They also benefit from strong domestic demand with per capita consumption of 40 kg (88 lbs).

From what we can figure Spain will continue to grow its production. It also has abundant packer capacity already in place.

Summary

- U.S. Hogs and Pig Report- inventory up 2.5 million

- E.U. down about the same amount in production

- China inventory down 200 million head range

- China could use some serious pork imports

Main question – until when?

Categorised in: Featured News, Pork Commentary

This post was written by Genesus