Canada – Slow and Steady Wins the Race?

Bob Fraser – Sales & Service, Genesus Ontario

StatsCan recently released its July 1st hog inventory report. It placed total inventory of all hogs at 14.1 million head up 2% from a year ago. The market hog inventory was up 2% while the sow inventory was up 1%. Hardly earth shattering expansion, 6700 sows in Manitoba, Saskatchewan 2700 and Alberta 1700. Barely perceptible moves. Interestingly StatsCan claims no growth in the Ontario sow herd after 4% growth (10,000 sows) claimed in January. At the field level one would wonder if that is exactly right, as there seems to be continued growth with numerous new barns, renovations and expansions in motion.

The Canadian sow herd from a peak of over 1.7 million sows in 2005 went through a long stretch of “tough sledding”. This resulted in two different “buy outs” in Ontario and the herd contracting by 26% by 2011 to less than 1.3 million sows. The industry spent the next four years from 2011 through 2014 basically treading water. Then 2014 courtesy of PED gave a year for the record books for profitability. This in the past would have lead to explosive expansion but the crater to equity of the previous decade placed a major governor on that. Now with the addition of two to three decently profitable years’ things seem to be beginning to stir in Ontario at least.

There also seems to be other factors at play. The so called “new, good” barns in Ontario are mostly from the Premium Pork era and fifteen years old on their way to twenty. The balance of the barns is north of that. So we have a plant that is in essence wore out. So this is first fork in the road for many Ontario producers. The second fork in the road is the need to contend with stalls sometime early in the next decade. So this is forcing many producers to the decision of “go big or go home” and both decisions are being made. As always the long term trend is intact of probably more producers exiting than entering but those remaining (more than entering) are getting bigger. Two factors seem to be driving this. One, most Ontario (Dutch) producers naturally assume with any major expenditure you’re going to need more sows to pay for it. Therefore, there seems to be significant internal growth, which may or may not be being fully picked up by StatsCan. Second driver appears to be labour. We are seeing a generational shift with sons and daughters returning to the farm often in their thirties after working for some period of time off farm. The romance is coming off cash crop farming with its high land prices and receding memory of seven-dollar corn. Such that the sustainable model which I’ve written about off walking the crop off the farm in hogs appears to be gaining appeal. However, this generation is less inclined to be wed to the sow barn 24/7. As one young producer explained to me “if I build a 500 sow barn and an employee quits, I’m then in the barn more than full time. If I build a 1500+ sow and an employee quits the rest work a little harder till we get a replacement but I’m not forced into the barn more than I wish”. Hence although there will always be smaller operations in Ontario for those who have circumstances in which this works for them the trend appears to be in 1500 to 3000 sow units.

One final factor to the Ontario growth. Ontario has been marketing 112,000 + market hogs per week in 2017. About 80,000 go to the two federally inspected plants (Sofina & Conestoga – combined 73,000) with the balance to several provincially inspected plants. A handful (3000) finds their way to the US. However, the bulk some 30,000 head now go to Quebec, primarily Olymel. This has evolved into an interesting symbiotic relationship. Where Quebec packers used to be a thorn in the side of Ontario packers’ cherry picking a few hogs from the province but driving up the price of all the hogs, now the two Ontario plants are at capacity so seemingly little bothered by the intrusion of another buyer (at least for now). Quebec has kill capacity of some 190,000 per week and with a seemingly stagnant flat production of 140,000 per week necessity becomes the mother of invention. The extra Ontario production very much becomes a requirement to achieve anything like acceptable plant utilization. So for now at least mutual need seems to be leading to mutual win/win.

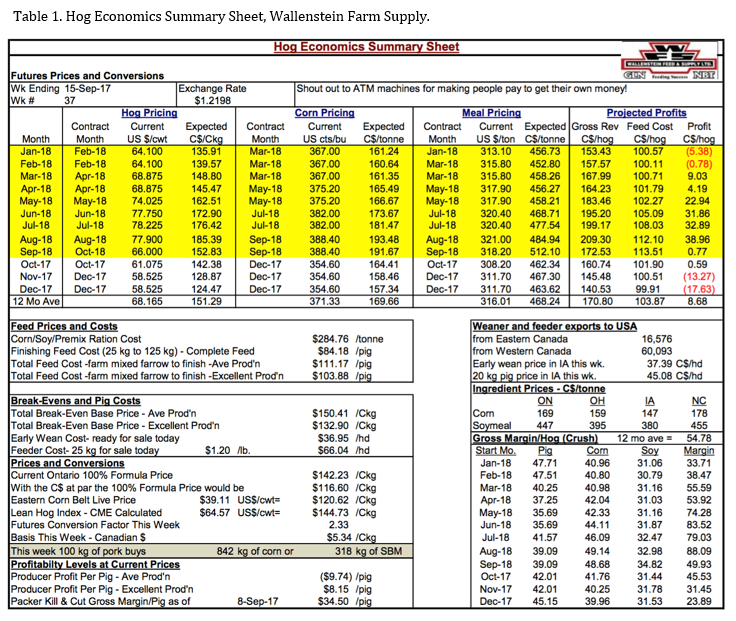

Hog profitability has shifted significantly in the six weeks since my last commentary. Here courtesy of Bob Hunsberger, Wallenstein Farm Supply (Table 1). Projected profits currently for the next 12 months are $8.68 on average and a drop from the $12.11 of my last commentary. Also present margins with average production have dipped into the red at ($9.74) from $54.28 (a precipitous drop) and with excellent production to $8.15 from $72.68 from last commentary. However, Packer kills & cut gross margin remain robust at $34.50 which should very much keep them in the hunt.

Categorised in: Featured News, Global Markets

This post was written by Genesus