Simon Grey – General Manager, Russia CIS and Europe

This weeks Global Market Report for Russia is about the Global Market Report! Last week Genesus attended and spoke at a conference organised by the Russian Pig Producers Association. This association is well organised in Russia with good leadership that understands the reality of the effects of the development of the Russian pig industry.

Latest government targets are for Russia to become a net exporter. A good part of the conference was dedicated to this and to all the efforts the Government is making to break down trade barriers and to open export markets.

Russia’s target is to become the worlds 5th largest exporter of pigmeat. Russia target revenues of $45 billion from the export of agricultural product from Russia by 2020.

The pig price this week in Russia is 117 Roubles ($1.76) per kg live including 10% VAT. According to Russian pig Producer’s Association average production cost for average producer are in the mid 80 Roubles per kg. This means today the average producer is making about 2400 Roubles per pig ($36) and the top producers who have costs below 60 Roubles are making 5400 Roubles ($81). This of course means happy producers.

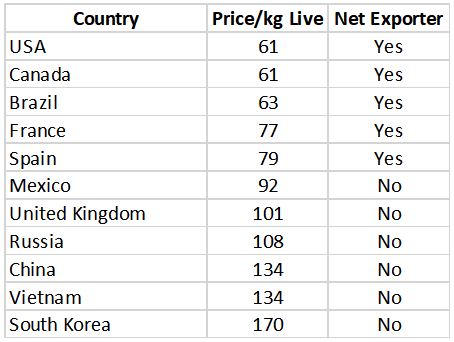

Now let look at figures from Global Market Report from last week. The numbers are very representative of the past year.

Looking at this table the average Russian pig producers should be very concerned. The pig price in the net exporting countries is always considerably lower than the price in the net importing counties. Russian consumers of course will be very happy!!!

Russia wants to go from being a net importer, where pig price can be manipulated by restricting imports and keeping the balance of supply and demand in the favour of the producer, to a net exporter, where pigmeat HAS to be exported every week to avoid catastrophic price reduction!

Europe as a whole (27 countries) is today the worlds 2nd largest exporter. But as a % of production the % exported is considerably less than countries like Canada, USA and Brazil. Except for Spain, Europe is losing sows year after year. The major producing countries of Europe (Germany, France, Holland, Denmark) all expect pig herd to reduce (due to high cost of production). Currently farmers in Denmark are going bankrupt weekly! You can have the highest born alive in the world, but if your costs are too high you still go bankrupt!!

I would expect the EU within 10 years to become a net importer of pigmeat if production continues to reduce at the current rate.

For Russia this means the competition for the export market will be with USA, Canada and Brazil. One issue also discussed at the conference is that the Russian market opens for Brazilian imports in January – and what effect will that have on price!!

The most likely scenario over time is that the pig price in Russia will align with USA, Canada and Brazil. That means prices in the 60’s Roubles per kg will be the norm.

For Russian pig producers this means to remain profitable costs need to be in the late 50’s or early 60’s Roubles/kg.

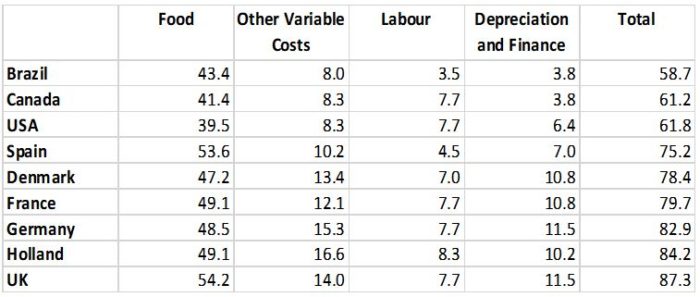

The following table is cost of production. Of-course with these types of figures there is a good deal of estimation and averaging. The principle of the difference in costs is more important than the actual. In all countries the best producers are better than the worst!

The most important point here is that the net exporting countries have the LOWEST cost of production THEY HAVE TOO….. You can see also why the main pig producing countries of Europe will lose production. Their costs are too high globally. The UK with one of the highest cost of production in Europe has lost 50% of its production in the past 18 years and is now only 50% SELF SUFFICIENT IN PIGMEAT!!

Russian pig farmers must start to really focus on cost. This means really understanding what this means. For me there is another real obvious when you look at the cost table. If you want to understand low cost pig production in Russia – look towards Canada and the USA and NOT EUROPE!! Russia naturally has so much more in common with Canada and certainly the northern half of the USA. The climate is very similar, so feed raw materials can be the same. Buildings and microclimate systems that work well in Canada and USA will of course work in Russia. Even methods of construction can be the same.

Current feed raw material costs or metric Tonne are Corn 10,000 Roubles $149, Wheat 12,500 Roubles $187, Barley 13,000 Roubles $194. Many Russian farmers are using Barley in pig diets (and no Corn)!!! At these prices why?? Mostly traditional belief that you have to include barley in diets and that Corn is bad because it contains micotoxins!! When the pig price is in the 60’s tradition needs to go out of the window really quickly!!

Russian pig producers have in General built very expensive European style buildings in the past. Why would finance and depreciation costs be considerably lower in the Americas than Europe – most of this cost is buildings and equipment finance and depreciation.

North Americans understand very well what drives profitability on farms and meat plants. More kg!!! This means bigger pigs and lower mortality in nursery and finisher. For the slaughter plant its just kg (bigger pigs at slaughter). Many slaughter plants in North America has turned off their grading machines and just pay on weight.

Europe still mostly obsesses about lean meat % and now not castrating boars. Both of these factors reduce slaughter weight and increase cost of production. Both also produce pig meat many consumers do not want to buy (pale and lean and with risk of boar taint).

As a genetic supplier we see some differences also. In the Americas 50% of our customer base produce their own F1 gilts by buying pure gilts and semen (internal multiplication) the other 50% just buy F1 gilts. None even think of wanting to run internal Nucleus or even less do their own genetic program. North American farmers actually will pay more for their genetics than in Europe (they understand the value). They understand they do not want to get focus diverted away from commercial low-cost pig production and more importantly do not want NOT TO GET genetic progress.

I see the same thing in Russia. The big and low-cost producers work with one of the 4 Global breeding companies. Buy boars and have internal gilt production managed by the global company. For these producers, genetics cost is in the 60’s Roubles per pig or about 0.7% of all of their cost of production. Genetic progress over the past 5 years with Genesus has been worth about 285 Roubles per pig in Russia. Now with full Genomic selection the rate of genetic improvement will rise.

The return of investment in Genetics has been about 500% (5X).

Many of the high cost producers in Russia either do not use genetics from one of the top 4 genetic companies or they ‘do it themselves’ buying a few boars or gilts. Even cheap Russian Genetics or DIY Genetics is not free. At best the cash saving could be 0.25% to 0.3% of cost Vs the loss from reduced genetic progress.

If your costs today are not in the 60’s Roubles per kg worrying about Genetics is totally irrelevant. If you got your genetics for free it will not help you. You need to reduce cost by 10% to 30%!

As a consultant I always used to tell farmers the best management tool ever is a calculator. To be honest when pig price has been in the range of 90 Roubles to 130 Roubles the only reason for a calculator was to work out how many $millions you were making. With a pig price in the 60’s Roubles you really need to start calculating what EVERYTHING COSTS and which costs you can immediately get rid of (anything that does not increase production).

If you are currently building, you seriously need to look at building what you can afford – not what you want!! Canada does not have a low cost of production by accident!!!

Categorised in: Featured News, Global Markets

This post was written by Genesus