Market Report USA

Allen Bentley, Sales Representative, Genesus Inc.

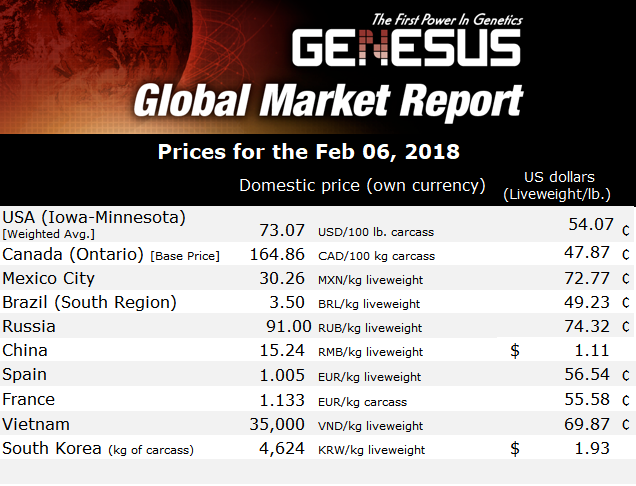

Cash hogs are approaching $60 live, in February, I don’t think even Punxsutawney Phil saw that coming.

Dressed values around $72 base prices are narrowing up the basis, this is unusual for this time year historically. The actual basis is more in line with summer time.

Cash hogs are defiantly pushing hog’s futures as February hogs have gained $8.00 since Christmas.

Packer margins have been squeezed and without help from cut-out values, we might have a little trouble pushing cash much higher from this level. Although the demand is strong, the downside is limited, as these packers are actively competing for hogs.

I see no reason to be hedging any summer hogs at these levels. Summer futures at $83 is really not rewarding you when cash hogs in February are $60. Every operation has different marketing plan, but it looks like staying on the cash market will be the winner.

If anything, it looks like futures should be bought, as they are just too cheap compared to where cash is today. When that actual basis is narrow either cash needs to fall, or more than likely futures will push higher.

Again, watch the cut-out value and basis for market signals. Also, key to prices going forward will be exports, so we need to keep a sharp eye on them.

Categorised in: Featured News, Global Markets

This post was written by Genesus