Pork Commentary

Jim Long President – CEO Genesus Inc.

September 30, 2013

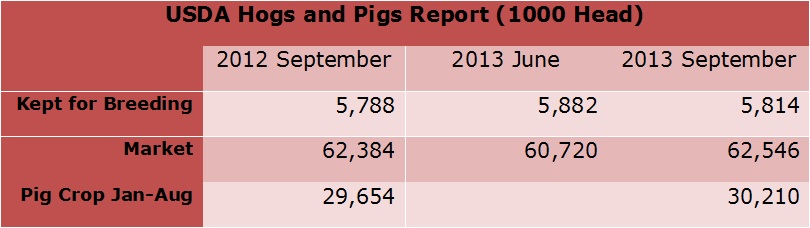

USDA September Hog and Pigs Report

The USDA released last week the September 1st Hogs and Pigs Report. From our perspective it confirms our belief in strong hog prices over the next ten months. No more breeding animals or market hogs than last year with what we believe is strong current domestic and export pork demand.Breeding Herd

A handful of more sows than last year September 1st with the USDA stating that the breeding herd declined about 70,000 from June 1 to September 1 this year. The breeding herd on September 1st is for all intents and purposes the base for the production of market hogs through next summer. There will be significantly more hogs with no more sows. It’s biologically impossible. Couple that with the PED disease that has hit and its subsequent resulting mortality we cannot comprehend more pigs being produced over the next several months.Market

The USDA has the same number of market hogs year over year on September 1st. So far year to date the US has marketed 1% fewer. Of note, March 1 and June 1, USDA market inventories indicated 100% year over year market inventories. The actual marketings have been lower. The USDA in their September 1 report indicates that over the last 20 reports they have had all Hogs and Pigs estimated 14 of the 20 times as higher than they actually turned out. The USDA estimates that chances are 2 out of 3 that the final estimate will not be above or below the current estimate of 68.4 million by more than 0.8 per cent. Point is there is little chance we have significantly more hogs coming. Pork demand is strong and with little chance of more hogs we can expect lean hog prices to stay above last year prices. Couple that with the lower feed prices, profitability over the next ten months will be excellent. As we wrote last week, we have had ten weeks of profits! The equity hole that has been created over the last multiple months is huge. We still expect little expansion for months ahead. The industry needs to heal before much of anything happens. There will be talk. Talk is cheap. It takes courage and capital to expand. Not many have both. Expansion won’t happen in a minute.PIC (Genus) buys Genetiporc

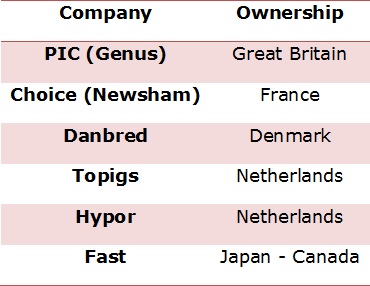

The Global Swine Genetic business continues to consolidate with the announcement last week that PIC (Genus) is purchasing Canada based Genetiporc. Genetiporc had sales last year (Ending June) of $60 million US with a breakeven profit. PIC (Genus) will pay $30 million USD and assumption of $5.6 million USD of debt. PIC expects to at full run rate, synergies of USD $11 million per annum as the operations of Genetiporc are combined with Genus PIC business.Our Observations

We expect the $11 million USD in synergy savings will be accomplished by Genetiporc genetic development ending and PIC genetics being incorporated in Genetiporc’s genetic production base. We expect Genetiporc customers will be offered PIC products in the future. It appears the Genetiporc brand will disappear. To accomplish $11 million USD in savings, there will have to be fewer employees in the future compared to what there is today at both PIC and Genetiporc. We expect the price for breeding stock in the USA will increase. Genetiporc was selling $60 million/year but couldn’t make money. One of the advantages for PIC in this purchase is the possibility to increase profit margins with the elimination of Genetiporc. With the purchase of Genetiporc there is only one wholly owned Canadian, North American and Western Hemisphere global genetic company left. It’s us Genesus! Does it matter that Genesus is the only one left? Not really if we don’t bring value to our customers. Our Genetic Research and Development team, has the capital and knowledge to have continual improvement. It’s game on!

Does it matter that Genesus is the only one left? Not really if we don’t bring value to our customers. Our Genetic Research and Development team, has the capital and knowledge to have continual improvement. It’s game on!

Categorised in: Pork Commentary

This post was written by Genesus